Lexmark 2009 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Company uses the specific identification method when accounting for the costs of its available-for-sale

marketable securities sold.

Impairment

On April 1, 2009, the Company adopted the amended FASB guidance on the recognition and presentation

of OTTI, which requires that credit related other-than-temporary impairment on debt securities be

recognized in earnings while noncredit related other-than-temporary impairment of debt securities not

expected to be sold be recognized in other comprehensive income. See Note 2 for the Company’s policy

on evaluating its marketable securities for OTTI.

In accordance with the new guidance, the noncredit related portion of other-than-temporary impairment

losses recognized in prior earnings was reclassified as a cumulative effect adjustment that increased

retained earnings and decreased accumulated other comprehensive income at April 1, 2009. In periods

prior to adoption of the new guidance, a total of $7.5 million had been recognized through earnings as

other-than-temporary impairment. Upon adoption the Company recorded a cumulative effect increase to

retained earnings, and to the amortized cost of previously other-than-temporarily impaired debt securities

that increased the gross unrealized losses on available-for-sale securities by $2.1 million. The cumulative

effect adjustment to retained earnings at April 1, 2009 totaled $1.4 million net of tax.

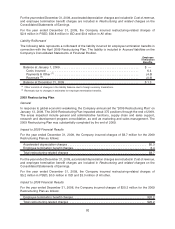

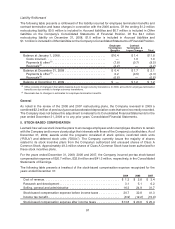

For the year ended December 31, 2009, the following table provides a summary of the total

other-than-temporary impairment losses incurred, the portion recognized in Accumulated other

comprehensive loss for the noncredit portion of other-than-temporary impairment, and the net credit

losses recognized in Net impairment losses on securities on the Consolidated Statements of Earnings:

(In Millions) 2009

Total other-than-temporary impairment losses on securities . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4.6

Portion of loss recognized in other comprehensive income (before tax) . . . . . . . . . . . . . . . . . (1.5)

Net impairment losses on securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3.1

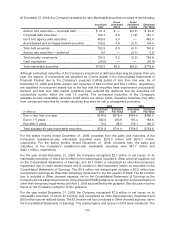

The $3.1 million credit loss is made up of $0.6 million for other-than-temporary impairment related to asset-

backed and mortgage-backed securities, $1.2 million for other-than-temporary impairment related to

certain distressed corporate debt securities, and $1.3 million for other-than-temporary impairment related

to certain auction rate securities. As of December 31, 2009, the Company has recognized a cumulative,

pre-tax valuation allowance of $0.9 million included in Accumulated other comprehensive loss

representing a temporary impairment of the overall portfolio.

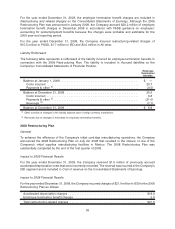

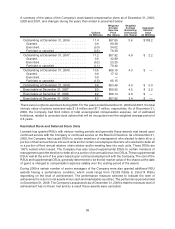

The following table presents the amounts recognized in earnings for other-than-temporary impairments

related to credit losses for which a portion of total other-than-temporary impairment was recognized in

other comprehensive income:

(In Millions)

Beginning balance of amounts related to credit losses, January 1, 2009 . . . . . . . . . . . . . . . . . $ —

Credit losses on debt securities for which OTTI was not previously recognized . . . . . . . . . . . . 1.2

Additional credit losses on debt securities for which OTTI was previously recognized . . . . . . . 1.9

Ending balance of amounts related to credit losses, December 31, 2009. . . . . . . . . . . . . . . . . $3.1

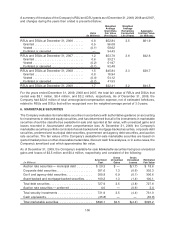

The following table provides information, at December 31, 2009, about the Company’s marketable

securities with gross unrealized losses for which no other-than-temporary impairment has been

incurred, and the length of time that individual securities have been in a continuous unrealized loss

102