Lexmark 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

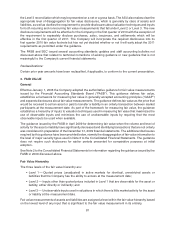

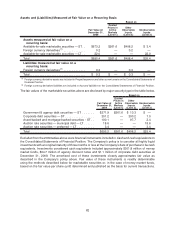

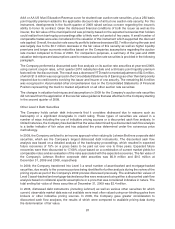

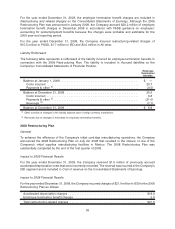

For purposes of comparison, the following information relates to December 31, 2008.

Fair Value at

December 31,

2008

Quoted

Prices in

Active

Markets

(Level 1)

Other

Observable

Inputs

(Level 2)

Unobservable

Inputs

(Level 3)

Based on

Assets measured at fair value on a

recurring basis:

Available-for-sale marketable securities — ST . . $694.1 $428.0 $264.7 $ 1.4

Available-for-sale marketable securities — LT . . 24.7 — — 24.7

Total................................. $718.8 $428.0 $264.7 $26.1

Liabilities measured at fair value on a

recurring basis:

Foreign currency derivatives

(1)

............. 1.5 — 1.5 —

Total................................. $ 1.5 $ — $ 1.5 $ —

(1)

Foreign currency derivative liabilities are included in Accrued liabilities on the Consolidated Statements of Financial Position.

Excluded from the table above were financial instruments included in Cash and cash equivalents on the

Consolidated Statements of Financial Position. Investments considered cash equivalents, which closely

approximate fair value as described in the Company’s policy above, included roughly $129.9 million of

money market funds and $36.0 million of US agency discount notes at December 31, 2008.

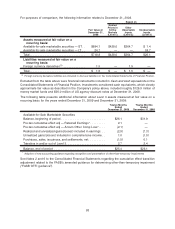

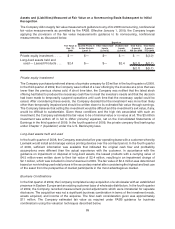

The following table presents additional information about Level 3 assets measured at fair value on a

recurring basis for the years ended December 31, 2009 and December 31, 2008:

Twelve Months

Ended

December 31, 2009

Twelve Months

Ended

December 31, 2008

Available-for-Sale Marketable Securities

Balance, beginning of period .......................... $26.1 $31.9

Pre-tax cumulative effect adj — Retained Earnings* ......... 2.1 —

Pre-tax cumulative effect adj — Accum Other Comp Loss*.... (2.1) —

Realized and unrealized gains/(losses) included in earnings . . (2.9) (7.3)

Unrealized gains/(losses) included in comprehensive income . . 1.0 (1.0)

Purchases, sales, issuances, and settlements, net. ......... (1.5) 0.1

Transfers in and/or out of Level 3....................... 2.7 2.4

Balance, end of period .............................. $25.4 $26.1

*

Adoption of new accounting guidance regarding recognition and presentation of other-than-temporary impairments

See Notes 2 and 6 to the Consolidated Financial Statements regarding the cumulative effect transition

adjustment related to the FASB’s amended guidance for determining other-than-temporary impairment

(“FASB OTTI guidance”).

83