Lexmark 2009 Annual Report Download - page 85

Download and view the complete annual report

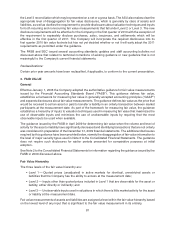

Please find page 85 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.fair value measurement of these investments. The ASU permits a reporting entity, as a practical expedient,

to estimate the fair value of the investment using the net asset value per share provided it is calculated in a

manner consistent with U.S. GAAP for investment companies at the reporting entity’s measurement date.

If net asset value per share is not calculated in such a manner, the reporting entity must consider whether

an adjustment to the most recent net asset value per share is necessary in order to estimate net asset

value in a manner consistent with U.S. GAAP as of the reporting entity’s measurement date. A reporting

entity is not allowed to use the practical expedient if it is probable that the entity will sell the investment for

an amount that is different from net asset value per share. ASU 2009-12 also contains disclosure

requirements for investments within scope that have been measured at fair value during the period

even if the practical expedient was not applied, though the disclosures do not apply to pension plan assets.

The guidance, which was first effective for the Company in the fourth quarter of 2009, did not have a

material impact to the Company’s fair value measurements as most of the Company’s investments have

readily determinable fair values.

Accounting Standards Issued But Not Yet Effective

In October 2009, the FASB issued ASU No. 2009-13, Revenue Recognition (Topic 605): Multiple-

Deliverable Revenue Arrangements (“ASU 2009-13”). ASU 2009-13 contains amendments to the ASC

that address how to determine whether a multiple-deliverable arrangement contains more than one unit of

accounting and how to measure and allocate arrangement consideration to the separate units of

accounting in the arrangement. The ASU does not provide revenue recognition guidance for a given

unit of accounting. ASU 2009-13 removes the requirement that there be objective and reliable evidence of

fair value of the undelivered item(s) in order to recognize the delivered item(s) as separate unit(s) of

accounting. Under the amended guidance, the delivered item(s) will be considered separate units of

accounting if both the delivered item(s) have value to the customer on a standalone basis and delivery or

performance of the undelivered item(s) is considered probable and substantially in the control of the

vendor when the arrangement includes a general right of return relative to the delivered item. ASU 2009-13

eliminates the use of the residual method when measuring and allocating arrangement consideration to

separate units of accounting. Under the amended guidance, arrangement consideration will be allocated

at the inception of the arrangement to all deliverables on the basis of their relative selling price. When

applying this method, an entity must adhere to the selling price hierarchy; that is, the selling price used for

each deliverable will be based on vendor-specific objective evidence (“VSOE”) if available, third-party

evidence (“TPE”) if vendor-specific objective evidence is not available, or estimated selling price if neither

VSOE nor TPE is available. The vendor’s best estimate of selling price is the price at which the vendor

would transact if the deliverable were sold by the vendor regularly on a standalone basis and should take

into consideration market conditions and entity-specific factors. ASU 2009-13 also expands ongoing

disclosure requirements for multiple-deliverable arrangements. The disclosure objective is to provide both

qualitative and quantitative information about a vendor’s revenue arrangements, significant judgments

made in applying the guidance, and changes in judgment or application of the guidance that may

significantly affect the timing or amount of revenue recognition. The new guidance under the ASU

must be applied either on a prospective basis to revenue arrangements entered into or materially

modified in the year 2011 or on a retroactive basis. Earlier application is allowed under the transition

guidance of the ASU; however, if an entity decides to elect earlier application and the period of adoption is

not the first reporting period in the entity’s fiscal year, the new guidance must be applied retrospectively

from the beginning of the entity’s fiscal year accompanied by certain required disclosures of previously

reported interim periods in the fiscal year of adoption. The reporting entity will also be required to provide

transition disclosures in the year of adoption that enable the reader to understand the effect of the change

in accounting principle. The required disclosures depend on whether the guidance is adopted on a

prospective basis or through retrospective application.

In October 2009, the FASB issued ASU No. 2009-14, Software (Topic 985) Certain Revenue

Arrangements That Include Software Elements (“ASU 2009-14”). ASU 2009-14 contains amendments

to the ASC that change the accounting model for revenue arrangements that include both tangible

products and software elements. Specifically, the ASU modifies the scope of existing software revenue

79