Lexmark 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

lost retail shelf space. Inkjet hardware AUR increased 13% YTY due to favorable product mix shift, partially

offset by a negative impact of pricing.

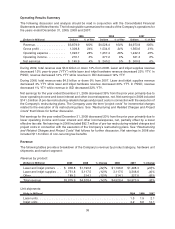

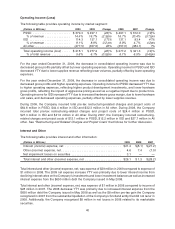

Revenue by geography:

The following table provides a breakdown of the Company’s revenue by geography:

(Dollars in Millions) 2009 % of Total 2008 % of Total % Change 2008 2007 % of Total % Change

United States . . . . . . . . $1,672.1 43% $1,864.8 41% (10)% $1,864.8 $2,140.3 43% (13)%

EMEA (Europe, the

Middle East &

Africa) . . . . . . . . . . . 1,453.9 38% 1,742.9 39% (17)% 1,742.9 1,827.2 37% (5)%

Other International . . . . 753.9 19% 920.7 20% (18)% 920.7 1,006.4 20% (9)%

Total revenue . . . . . . . . $3,879.9 100% $4,528.4 100% (14)% $4,528.4 $4,973.9 100% (9)%

During 2009, revenue decreased in all geographies due to lower laser and inkjet supplies and hardware

revenue. Currency exchange rates had a 3% unfavorable impact on revenue for the year 2009.

During 2008, revenue decreased in all geographies primarily due to lower laser and inkjet hardware

revenue as well as lower inkjet supplies revenue. Currency exchange rates had a 2% favorable impact on

revenue for the year 2008.

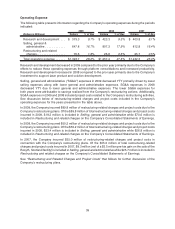

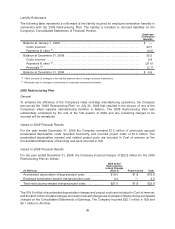

Gross Profit

The following table provides gross profit information:

(Dollars in Millions) 2009 2008 Change 2008 2007 Change

Gross profit dollars . . . . . . . . . . . . $1,309.8 $1,534.6 (15)% $1,534.6 $1,563.6 (2)%

% of revenue .............. 33.8% 33.9% (0.1)pts 33.9% 31.4% 2.5pts

During 2009, consolidated gross profit decreased when compared to the prior year while gross profit as a

percentage of revenue was relatively flat when compared to the prior year. The gross profit margin versus

the prior period was impacted by a 2.4 percentage point increase due to a favorable mix shift among

products, reflecting a lower relative percentage of hardware versus supplies, and a 2.1 percentage point

decrease due to product margins as well as a 0.4 percentage point decrease attributable to higher YTY

restructuring-related actions. Gross profit in 2009 included $51.5 million of restructuring-related charges

and project costs in connection with the Company’s restructuring activities. See “Restructuring and

Related Charges and Project Costs” that follows for further discussion.

During 2008, consolidated gross profit decreased when compared to the prior year while gross profit as a

percentage of revenue increased when compared to the prior year. The change in the gross profit margin

over the prior period was primarily due to a 5.3 percentage point increase due to a favorable mix shift

among products, primarily less inkjet hardware and more laser supplies, partially offset by a

2.3 percentage point decrease due to product margins and a 0.5 percentage point decrease

attributable to restructuring-related actions, primarily from an increase in accelerated depreciation

charges YTY. Gross profit in 2008 included $42.5 million of restructuring-related charges and project

costs in connection with the Company’s restructuring activities. See “Restructuring and Related Charges

and Project Costs” that follows for further discussion.

38