Lexmark 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

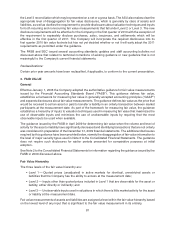

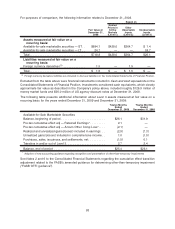

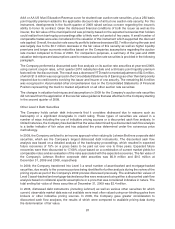

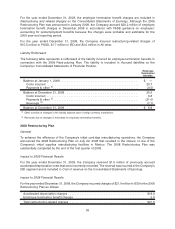

The 2009 Level 3 marketable securities fair value information above is disclosed by major security type in

the table below.

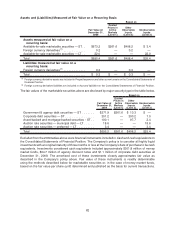

Twelve Months Ended,

December 31, 2009

Total Level 3

Securities

Corporate Debt

Securities

AB And MB

Securities

ARS - Muni Debt

Securities

ARS - Preferred

Securities

Balance, beginning of period . . . . $26.1 $ 0.9 $ 0.5 $20.8 $ 3.9

Pre-tax cumulative effect adj —

Retained Earnings* . . . . . . . . . 2.1 1.4 — 0.7 —

Pre-tax cumulative effect adj —

Accum Other Comp Loss* . . . . (2.1) (1.4) — (0.7) —

Realized and unrealized

gains/(losses) included in

earnings. . . . . . . . . . . . . . . . . . (2.9) (1.2) (0.3) (1.4) —

Unrealized gains/(losses)

included in comprehensive

income. . . . . . . . . . . . . . . . . . . 1.0 1.7 0.2 (0.4) (0.5)

Purchases, sales, issuances, and

settlements, net . . . . . . . . . . . . (1.5) (0.4) (0.7) (0.4) —

Transfers in and/or out of

Level3................... 2.7 — 2.7 — —

Balance, end of period. . . . . . . . . $25.4 $ 1.0 $ 2.4 $18.6 $ 3.4

AB = Asset-backed

MB = Mortgage-backed

ARS = Auction rate security

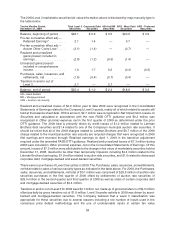

Realized and unrealized losses of $2.9 million year to date 2009 were recognized in the Consolidated

Statements of Earnings related to the Company’s Level 3 assets, nearly all of which related to assets still

held at the balance sheet date. Of this amount, $2.7 million was recognized in Net Impairment Losses on

Securities and calculated in accordance with the new FASB OTTI guidance and $0.2 million was

recognized in Other (income) expense, net in the first quarter of 2009 as determined under the prior

OTTI guidance. The 2009 total is primarily driven by credit losses of $1.2 million related to Lehman

Brothers debt securities and $1.4 related to one of the Company’s municipal auction rate securities. It

should be noted that all of the 2009 charges related to Lehman Brothers and $0.7 million of the 2009

charge related to the municipal auction rate security are recycled charges that were recognized in 2008

Net earnings and reversed through Retained earnings on April 1, 2009 in the transition adjustment

required under the amended FASB OTTI guidance. Realized and unrealized losses of $7.3 million during

2008 were included in Other (income) expense, net on the Consolidated Statements of Earnings. Of this

amount, losses of $7.3 million were attributable to the change in fair value of marketable securities held at

December 31, 2008, deemed to be other than temporarily impaired, including $4.4 million related to the

Lehman Brothers bankruptcy, $1.9 million related to auction rate securities, and $1.0 related to distressed

corporate debt, mortgage-backed and asset-backed securities.

There were no purchases of Level 3 securities in 2009. The Purchases, sales, issuances, and settlements,

net total relate to sales of various security types as indicated in the table above. For 2008, the Purchases,

sales, issuances, and settlements, net total of $0.1 million was comprised of $28.5 million of auction rate

securities purchases in the first quarter of 2008 offset by settlements of auction rate securities of

$28.0 million in the second quarter and third quarter of 2008 as well as sales of certain corporate debt

and mortgage-backed securities of $0.4 million.

Transfers in and/or out of Level 3 for 2009 were $2.7 million net, made up of gross transfers in of $4.5 million

offset partially by gross transfers out of $1.8 million. Level 3 transfer activity in 2009 was driven by asset-

backed and mortgage-backed securities. The Company believed that a Level 3 classification was

appropriate for these securities due to several reasons including a low number of inputs used in the

consensus price default methodology and the use of unobservable inputs in certain fair value

84