Lexmark 2009 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.factors to be considered when estimating whether a credit loss exists and the period over which the debt

security is expected to recover, some of which have been highlighted in the preceding paragraph.

Given the uncertainty in the current economic environment and the level of judgment required to make the

assessments above, the final outcomes of the Company’s investments in debt securities could prove to be

different than the results reported. Issuers with good credit standings and relatively solid financial

conditions may not be able to fulfill their obligations ultimately. Furthermore, the Company could

reconsider its decision not to sell a security depending on changes in its own cash flow projections as

well as changes in the regulatory and economic environment that may indicate that selling a security is

advantageous to the Company. Historically, the Company has incurred a low amount of realized losses

from sales of marketable securities.

See Note 6 to the Consolidated Financial Statements in Part II, Item 8 for more information regarding the

Company’s marketable securities.

Goodwill

The Company assesses its goodwill annually or upon the occurrence of a triggering event that leads

management to believe it is more likely than not that an impairment exists, such as the market

capitalization of the overall Company being less than its carrying value. The Company’s goodwill

assets are immaterial, and therefore are not separately presented in the Consolidated Statements of

Financial Position. The fair value of each reporting unit tested at December 31, 2009 was substantially in

excess of its carrying value.

Long-Lived Assets

Lexmark performs reviews for the impairment of long-lived assets whenever events or changes in

circumstances indicate that the carrying amount of an asset may not be recoverable. If the estimated

undiscounted future cash flows expected to result from the use of the assets and their eventual disposition

are insufficient to recover the carrying value of the assets, then an impairment loss is recognized based

upon the excess of the carrying value of the assets over the fair value of the assets. Such an impairment

review incorporates estimates of forecasted revenue and costs that may be associated with an asset as

well as the expected periods that an asset may be utilized. Fair value is determined based on the highest

and best use of the assets considered from the perspective of market participants, which may be different

than the Company’s actual intended use of the asset.

Lexmark also reviews any legal and contractual obligations associated with the retirement of its long-lived

assets and records assets and liabilities, as necessary, related to such obligations. The asset recorded is

amortized over the useful life of the related long-lived tangible asset. The liability recorded is relieved when

the costs are incurred to retire the related long-lived tangible asset. Each obligation is estimated based on

current law and technology; accordingly, such estimates could change as the Company periodically

evaluates and revises such estimates based on expenditures against established reserves and the

availability of additional information. The Company’s asset retirement obligations are currently not material

to the Company’s Consolidated Statements of Financial Position.

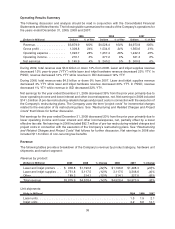

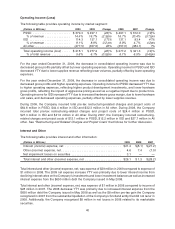

RESULTS OF OPERATIONS

Operations Overview

Key Messages

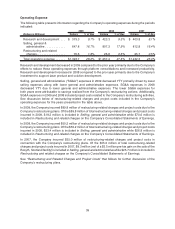

Lexmark is focused on driving long-term performance by strategically investing in technology, products

and solutions to secure high value product installations and capture profitable supplies and service

annuities in document and print intensive segments of the distributed printing market.

• The PSSD strategy is primarily focused on capturing profitable supplies and service annuities

generated from workgroup monochrome and color laser printers and laser MFPs.

34