Lexmark 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

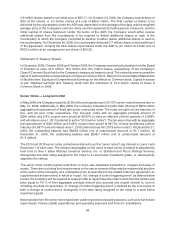

Lexmark International, Inc. and Subsidiaries

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY AND COMPREHENSIVE EARNINGS

For the years ended December 31, 2009, 2008 and 2007

(In Millions)

Shares Amount

Capital in

Excess

of Par

Retained

Earnings

Treasury

Stock

Accumulated

Other

Comprehensive

Earnings

(Loss)

Total

Stockholders’

Equity

Class A

and B

Common Stock

Balance at December 31, 2006 ...................... 97.0 $ 1.1 $ 827.3 $ 627.5 $(289.8) $(130.9) $1,035.2

Comprehensive earnings, net of taxes . . . . . . . . . . . . .......

Net earnings . . . . . . . . . . . . .................... 300.8 300.8

Other comprehensive earnings (loss):

Pension or other postretirement benefits, net of reclass ....... 17.5

Cash flow hedges, net of reclassifications . . . . . . . . ....... (0.7)

Translation adjustment, net of reclassification . . . . . . ....... 22.5

Net unrealized gain (loss) on marketable securities . . ....... —

Other comprehensive earnings (loss) . . . . . . . . . . . ....... 39.3 39.3

Comprehensive earnings, net of taxes . . . . . . . . . . . . ....... 340.1

Adoption of new guidance — Uncertainty in income taxes

(1)

....... 7.4 7.4

Shares issued under deferred stock plan compensation . . ....... 0.1 0.1

Shares issued upon exercise of options . . . . . . . . . . . ....... 0.3 10.0 10.0

Shares issued under employee stock purchase plan . . . . ....... 0.1 5.6 5.6

Tax benefit (shortfall) related to stock plans . . . . . . . . . ....... 3.6 3.6

Stock-based compensation . . . . . .................... 41.2 41.2

Treasury shares purchased . . . . . .................... (2.7) (165.0) (165.0)

Treasury shares issued . . . . . . . . .................... — 0.1 0.1

Balance at December 31, 2007 ...................... 94.7 1.1 887.8 935.7 (454.7) (91.6) 1,278.3

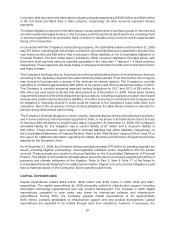

Comprehensive earnings, net of taxes . . . . . . . . . . . . .......

Net earnings . . . . . . . . . . . . .................... 240.2 240.2

Other comprehensive earnings (loss):

Pension or other postretirement benefits, net of reclass ....... (124.0)

Cash flow hedges, net of reclassifications . . . . . . . . ....... —

Translation adjustment . . . . . .................... (63.4)

Net unrealized gain (loss) on marketable securities . . ....... (1.3)

Other comprehensive earnings (loss) . . . . . . . . . . . ....... (188.7) (188.7)

Comprehensive earnings, net of taxes . . . . . . . . . . . . ....... 51.5

Shares issued under deferred stock plan compensation . . ....... 0.2 —

Shares issued upon exercise of options . . . . . . . . . . . ....... 0.2 4.2 4.2

Shares issued under employee stock purchase plan . . . . ....... 0.1 2.1 2.1

Tax benefit (shortfall) related to stock plans . . . . . . . . . ....... (2.2) (2.2)

Stock-based compensation . . . . . .................... 32.7 32.7

Treasury shares purchased . . . . . .................... (17.5) (554.5) (554.5)

Treasury shares issued . . . . . . . . .................... —

Treasury shares retired . . . . . . . . .................... (0.2) (121.1) (483.4) 604.7 —

Balance at December 31, 2008 ...................... 77.7 0.9 803.5 692.5 (404.5) (280.3) 812.1

Comprehensive earnings, net of taxes . . . . . . . . . . . . .......

Net earnings . . . . . . . . . . . . .................... 145.9 145.9

Other comprehensive earnings (loss):

Pension or other postretirement benefits, net of reclass ....... 8.7

Cash flow hedges, net of reclassifications . . . . . . . . ....... —

Translation adjustment . . . . . .................... 27.8

Net unrealized gain (loss) on OTTI mark sec, net of reclass . . . . 1.1

Net unrealized gain (loss) on marketable securities, net of

reclass . . . . . . . . . . . . . .................... 1.8

Other comprehensive earnings (loss) . . . . . . . . . . . ....... 39.4 39.4

Comprehensive earnings, net of taxes . . . . . . . . . . . . ....... 185.3

Adoption of new accounting guidance — OTTI

(2)

............. 1.4 (1.7) (0.3)

Shares issued under deferred stock plan compensation . . ....... 0.4 —

Tax benefit (shortfall) related to stock plans . . . . . . . . . ....... (3.9) (3.9)

Stock-based compensation . . . . . .................... 20.4 20.4

Balance at December 31, 2009 ...................... 78.1 $ 0.9 $ 820.0 $ 839.8 $(404.5) $(242.6) $1,013.6

(1) Adjustment to retained earnings related to the adoption of accounting guidance regarding uncertainty in income taxes was

$7.340 million

(2) Cumulative effect adjustment related to the adoption of accounting guidance regarding recognition and presentation of

other-than-temporary impairments

See notes to consolidated financial statements.

67