Lexmark 2009 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.New legislation, fees on the Company’s products or litigation costs required to protect the Company’s

rights may negatively impact the Company’s cost structure, access to components and operating results.

• Certain countries (primarily in Europe) and/or collecting societies representing copyright owners’

interests have commenced proceedings to impose fees on devices (such as scanners, printers and

multifunction devices) alleging the copyright owners are entitled to compensation because these

devices enable reproducing copyrighted content. Other countries are also considering imposing

fees on certain devices. The amount of fees, if imposed, would depend on the number of products

sold and the amounts of the fee on each product, which will vary by product and by country. The

financial impact on the Company, which will depend in large part upon the outcome of local

legislative processes, the Company’s and other industry participants’ outcome in contesting the

fees and the Company’s ability to mitigate that impact by increasing prices, which ability will depend

upon competitive market conditions, remains uncertain. The outcome of the copyright fee issue

could adversely affect the Company’s operating results and business.

The Company’s inability to obtain and protect its intellectual property and defend against claims of

infringement by others may negatively impact the Company’s operating results.

• The Company’s success depends in part on its ability to develop technology and obtain patents,

copyrights and trademarks, and maintain trade secret protection, to protect its intellectual property

against theft, infringement or other misuse by others. The Company must also conduct its

operations without infringing the proprietary rights of others. Current or future claims of

intellectual property infringement could prevent the Company from obtaining technology of

others and could otherwise materially and adversely affect its operating results or business, as

could expenses incurred by the Company in obtaining intellectual property rights, enforcing its

intellectual property rights against others or defending against claims that the Company’s products

infringe the intellectual property rights of others, that the Company engages in false or deceptive

practices or that its conduct is anti-competitive.

Cost reduction efforts associated with the Company’s compensation and benefits programs could

adversely affect our ability to attract and retain employees.

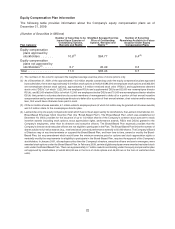

• The Company has historically used share-based payment awards as key components of the total

rewards program for employee compensation in order to align employees’ interests with the

interests of stockholders, motivate employees, encourage employee retention and provide

competitive compensation and benefits packages. As a result of efforts to reduce corporate

expenses, the Company has reviewed its compensation strategy and reduced the number of

employees receiving share-based awards and reduced the size of the awards. Due to this change in

compensation strategy, combined with other compensation and benefit plan changes and

reductions undertaken to reduce costs, the Company may find it difficult to attract, retain and

motivate employees, and any such difficulty could materially adversely affect its operating results.

Business disruptions could seriously harm our future revenue and financial condition and increase our

costs and expenses.

• Our worldwide operations and those of our manufacturing partners, suppliers, and freight

transporters, among others, are subject to natural and manmade disasters and other business

interruptions such as earthquakes, tsunamis, floods, hurricanes, typhoons, fires, extreme weather

conditions, environmental hazards, power shortages, water shortages and telecommunications

failures. The occurrence of any of these business disruptions could seriously harm our revenue and

financial condition and increase our costs and expenses. As the Company continues its

consolidation of certain functions into shared service centers and movement of certain functions

to lower cost countries, the probability and impact of business disruptions may be increased over

time.

18