Lexmark 2009 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

monopolistic conduct and unfair and deceptive trade practices in violation of the Sherman Act, the Lanham

Act and state laws. SCC has stated in its legal documents that it is seeking approximately $17.8 million to

$19.5 million in damages for the Company’s alleged anticompetitive conduct and approximately $1 billion

for Lexmark’s alleged violation of the Lanham Act. Clarity has not stated a damage dollar amount. SCC and

Clarity are seeking treble damages, attorney fees, costs and injunctive relief. On September 28, 2006, the

District Court dismissed the counterclaims filed by SCC alleging that the Company engaged in anti-

competitive and monopolistic conduct and unfair and deceptive trade practices in violation of the Sherman

Act, the Lanham Act and state laws. On October 13, 2006, SCC filed a Motion for Reconsideration of the

District Court’s Order dismissing SCC’s claims, or in the alternative, to amend its pleadings, which the

District Court denied on June 1, 2007. On June 20, 2007, the District Court Judge ruled that SCC directly

infringed one of Lexmark’s patents-in-suit. On June 22, 2007, the jury returned a verdict that SCC did not

induce infringement of Lexmark’s patents-in-suit. As to SCC’s defense that the Company has committed

patent misuse, in an advisory, non-binding capacity, the jury did find some Company conduct constituted

misuse. In the jury’s advisory, non-binding findings, the jury also found that the relevant market was the

cartridge market rather than the printer market and that the Company had unreasonably restrained

competition in that market. On October 3, 2008, the District Court Judge issued a memorandum opinion

denying various motions made by the Company that sought to reverse the jury’s finding that SCC did not

induce infringement of Lexmark’s patents-in-suit. The District Court Judge did, however, grant the

Company’s motion that SCC’s equitable defenses, including patent misuse, were moot. As a result,

the jury’s advisory findings on misuse, including the jury’s finding that the relevant market was the cartridge

market rather than the printer market and that the Company had unreasonably restrained competition in

that market, were not adopted by the District Court. On March 31, 2009, the District Court granted SCC’s

Motion for Reconsideration of an earlier Order that had found the Company’s terms used on certain supply

items that provide for an up-front discount in exchange for an agreement to use the supply item only once

were supported by patent law. The District Court Judge ruled that after the U.S. Supreme Court’s most

recent statement of the law regarding patent exhaustion the Company may not invoke patent law to

enforce these terms but state contract law may still be invoked. A final judgment for the 02 action and the 04

action was entered by the District Court on October 16, 2009. Notice of Appeal of the 02 and 04 actions has

been filed with the U.S. Court of Appeals for the Sixth Circuit. In the David Abraham and Clarity action, the

proceeding is in the discovery phase.

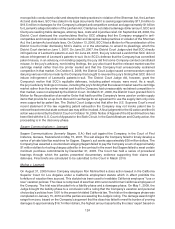

Sagem Communications v. Lexmark

Sagem Communications (formerly Sagem, S.A.) filed suit against the Company, in the Court of First

Instance, Geneva, Switzerland on May 15, 2007. The suit alleges the Company failed to timely develop a

series of private label fax machines for Sagem. Sagem’s suit seeks approximately $30 million dollars. The

Company has asserted a counterclaim alleging Sagem failed to pay the Company a sum of approximately

$1 million dollars for tooling charges called for in the contract in the event that Sagem failed to meet certain

minimum purchase commitments by December 31, 2005. The Court has held a series of procedural

hearings through which the parties presented documentary evidence supporting their claims and

defenses. Final briefs are scheduled to be submitted to the Court in March 2010.

Molina v. Lexmark

On August 31, 2005 former Company employee Ron Molina filed a class action lawsuit in the California

Superior Court for Los Angeles under a California employment statute which in effect prohibits the

forfeiture of vacation time accrued. This statute has been used to invalidate California employers’ “use or

lose” vacation policies. The class is comprised of less than 200 current and former California employees of

the Company. The trial was bifurcated into a liability phase and a damages phase. On May 1, 2009, the

Judge brought the liability phase to a conclusion with a ruling that the Company’s vacation and personal

choice day’s policies from 1991 to the present violated California law. The trial on the damages phase was

completed on January 15, 2010 and the parties are awaiting the Judge’s ruling. The damage award might

range from zero, based on the Company’s argument that the class has failed to meet its burden of proving

damages to approximately $16.7 million dollars, the highest amount asserted by the class’ expert based on

124