Lexmark 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LIQUIDITY AND CAPITAL RESOURCES

Financial Position

Lexmark’s financial position remains strong at December 31, 2009, with working capital of $949 million

compared to $805 million at December 31, 2008. The $144 million increase in working capital accounts

was primarily due to the $180 million increase in cash and cash equivalents as discussed below.

At December 31, 2009 and December 31, 2008, the Company had senior note debt of $648.9 million and

$648.7 million, respectively. The Company issued $650 million of new long-term debt in 2008, but used a

large portion of the proceeds to repurchase shares during the second half of 2008. The Company also

repaid $5.5 million of other short-term borrowings in 2009 that were outstanding at December 31, 2008.

The Company had no amounts outstanding under its U.S. trade receivables financing program or its

revolving credit facility at December 31, 2009, or December 31, 2008. The debt to total capital ratio was

39% at December 31, 2009, compared to 45% at December 31, 2008.

Liquidity

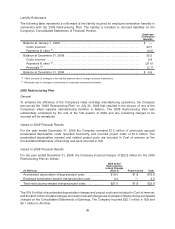

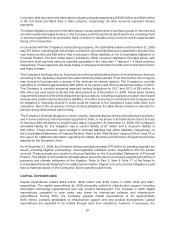

The following table summarizes the results of the Company’s Consolidated Statements of Cash Flows for

the years indicated:

(Dollars in Millions) 2009 2008 2007

Net cash flows provided by (used for):

Operating activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 402.2 $ 482.1 $ 564.2

Investing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (228.2) (427.6) (287.4)

Financing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.8 (48.1) (147.0)

Effect of exchange rate changes on cash . . . . . . . . . . . . . . . . . . . 2.3 (4.2) 2.6

Net increase (decrease) in cash and cash equivalents . . . . . . . . . $ 180.1 $ 2.2 $ 132.4

The Company’s primary source of liquidity has been cash generated by operations, which totaled

$402 million, $482 million and $564 million in 2009, 2008 and 2007, respectively. Cash from

operations generally has been sufficient to allow the Company to fund its working capital needs and

finance its capital expenditures during these periods along with the repurchase of approximately

$0.6 billion and $0.2 billion of its Class A Common Stock during 2008 and 2007, respectively. There

were no share repurchases in 2009. Management believes that cash provided by operations will continue

to be sufficient to meet operating and capital needs for the next twelve months. However, in the event that

cash from operations is not sufficient, the Company has a substantial cash and short term marketable

securities balance and other potential sources of liquidity through utilization of its accounts receivable

financing program, revolving credit facility (new agreement in third quarter of 2009) or other financing

sources as discussed below. As of December 31, 2009, the Company held $1.13 billion in cash and current

marketable securities.

Operating activities

Economic conditions impacted the Company’s revenue and profitability in 2009, as well as impacting cash

flow. First quarter 2009 cash flow was negative reflecting negative working capital performance and global

pension contributions of $78.6 million. However, the fourth quarter of 2009 marked the third consecutive

quarter of sequential improvement in cash generation. In addition, fourth quarter 2009 earnings showed

significant recovery from weak levels earlier in 2009 and cash flows from operating activities were strong at

$256.6 million. Although the Company continues to generate significant annual cash flow from operations,

the amounts generated have trended downward since 2006.

The $79.9 million decrease in cash flows from operating activities from 2008 to 2009 was driven by the

following factors.

51