Lexmark 2009 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

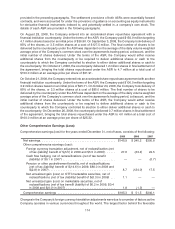

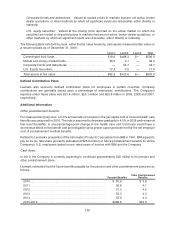

As of December 31, 2009 and 2008, the Company had the following net derivative assets recorded at fair

value in Prepaid expenses and other current assets on the Consolidated Statements of Financial Position

at December 31:

Foreign Exchange Contracts 2009 2008

Gross liability position . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(0.4) $—

Gross asset position . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.6 —

Net asset position . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.2 $—

As of December 31, 2009 and 2008, the Company had the following net derivative liabilities recorded at fair

value in Accrued liabilities on the Consolidated Statements of Financial Position at December 31:

Foreign Exchange Contracts 2009 2008

Gross liability position . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(0.7) $(2.7)

Gross asset position . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.4 1.2

Net liability position . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(0.3) $(1.5)

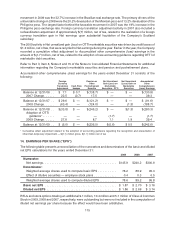

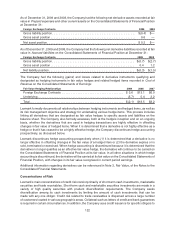

The Company had the following (gains) and losses related to derivative instruments qualifying and

designated as hedging instruments in fair value hedges and related hedged items recorded in Cost of

Revenue on the Consolidated Statements of Earnings:

Fair Value Hedging Relationships 2009 2008 2007

Foreign Exchange Contracts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3.6 $13.1 $6.0

Underlying . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (5.7) 5.4 2.2

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(2.1) $18.5 $8.2

Lexmark formally documents all relationships between hedging instruments and hedged items, as well as

its risk management objective and strategy for undertaking various hedge items. This process includes

linking all derivatives that are designated as fair value hedges to specific assets and liabilities on the

balance sheet. The Company also formally assesses, both at the hedge’s inception and on an ongoing

basis, whether the derivatives that are used in hedging transactions are highly effective in offsetting

changes in fair value of hedged items. When it is determined that a derivative is not highly effective as a

hedge or that it has ceased to be a highly effective hedge, the Company discontinues hedge accounting

prospectively, as discussed below.

Lexmark discontinues hedge accounting prospectively when (1) it is determined that a derivative is no

longer effective in offsetting changes in the fair value of a hedged item or (2) the derivative expires or is

sold, terminated or exercised. When hedge accounting is discontinued because it is determined that the

derivative no longer qualifies as an effective fair value hedge, the derivative will continue to be carried on

the Consolidated Statements of Financial Position at its fair value. In all other situations in which hedge

accounting is discontinued, the derivative will be carried at its fair value on the Consolidated Statements of

Financial Position, with changes in its fair value recognized in current period earnings.

Additional information regarding derivatives can be referenced in Note 3, Fair Value, of the Notes to the

Consolidated Financial Statements.

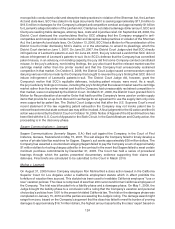

Concentrations of Risk

Lexmark’s main concentrations of credit risk consist primarily of short-term cash investments, marketable

securities and trade receivables. Short-term cash and marketable securities investments are made in a

variety of high quality securities with prudent diversification requirements. The Company seeks

diversification among its cash investments by limiting the amount of cash investments that can be

made with any one obligor. Credit risk related to trade receivables is dispersed across a large number

of customers located in various geographic areas. Collateral such as letters of credit and bank guarantees

is required in certain circumstances. In addition, the Company uses credit issuance for specific obligors to

122