Lexmark 2009 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

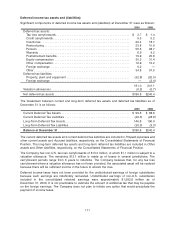

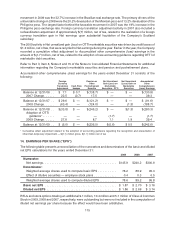

Deferred income tax assets and (liabilities)

Significant components of deferred income tax assets and (liabilities) at December 31 were as follows:

2009 2008

Deferred tax assets:

Tax loss carryforwards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3.7 $ 1.4

Credit carryforwards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.5 5.2

Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20.4 18.7

Restructuring . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23.8 10.8

Pension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 55.5 98.7

Warranty . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.9 9.2

Postretirement benefits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19.9 20.8

Equity compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30.2 31.4

Other compensation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.9 10.2

Foreign exchange . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.2 —

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34.8 57.6

Deferred tax liabilities:

Property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (32.8) (20.5)

Foreign exchange . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (2.4)

181.0 241.1

Valuation allowances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.2) (0.7)

Net deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $180.8 $240.4

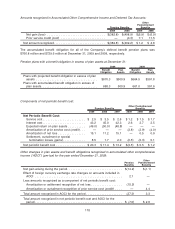

The breakdown between current and long-term deferred tax assets and deferred tax liabilities as of

December 31 is as follows:

2009 2008

Current Deferred Tax Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 99.6 $ 88.6

Current Deferred Tax Liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (26.3) (28.9)

Long-Term Deferred Tax Assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 146.8 190.0

Long-Term Deferred Tax Liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (39.3) (9.3)

Balance at December 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $180.8 $240.4

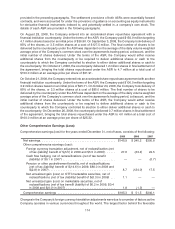

The current deferred tax assets and current deferred tax liabilities are included in Prepaid expenses and

other current assets and Accrued liabilities, respectively, on the Consolidated Statements of Financial

Position. The long-term deferred tax assets and long-term deferred tax liabilities are included in Other

assets and Other liabilities, respectively, on the Consolidated Statements of Financial Position.

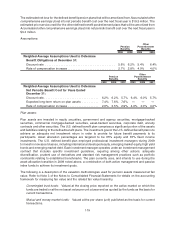

The Company has non-U.S. tax loss carryforwards of $13.2 million, of which $1.1 million is subject to a

valuation allowance. The remaining $12.1 million is made up of losses in several jurisdictions. The

carryforward periods range from 6 years to indefinite. The Company believes that, for any tax loss

carryforward where a valuation allowance has not been provided, the associated asset will be realized

because there will be sufficient income in the future to absorb the loss.

Deferred income taxes have not been provided for the undistributed earnings of foreign subsidiaries

because such earnings are indefinitely reinvested. Undistributed earnings of non-U.S. subsidiaries

included in the consolidated retained earnings were approximately $1,282.8 million as of

December 31, 2009. It is not practicable to estimate the amount of additional tax that may be payable

on the foreign earnings. The Company does not plan to initiate any action that would precipitate the

payment of income taxes.

111