Lexmark 2009 Annual Report Download - page 58

Download and view the complete annual report

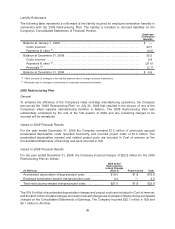

Please find page 58 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Changes in Trade receivables balances contributed $148.2 million to the decrease in cash flow from

operating activities from 2008 to 2009. Trade receivables decreased $150.5 million during 2008 compared

to a decrease of $2.3 million in 2009. During 2008, collections performance and days sales outstanding

improved significantly, reducing the trade receivables balance. During 2009, the Company maintained this

improved performance in days sales outstanding, as indicated in the days of sales outstanding

measurements included in the section to follow. Fourth quarter revenue in 4Q09 was only slightly

below 4Q08.

Net earnings decreased $94.3 million for full year 2009 as compared to full year 2008. Challenging

economic conditions negatively impacted the Company’s profitability during the first part of 2009 as well as

the operating cash flows that were ultimately realized. Additionally, pre-tax restructuring-related charges

and project costs increased $49 million full year 2009 compared to full year 2008 which also had a negative

impact on the Company’s profitability. However, many of these charges were either non-cash charges or

accruals of expenses not yet paid by the Company and therefore had a smaller impact on cash flow from

operations than on Net earnings. Lower Net earnings was also impacted by the increase in certain non-

cash charges which have no impact to cash flows from operations, such as deferred income tax

adjustments.

The activities above were partially offset by the following factors.

The reduction in Inventories balances was $55.1 million more in 2009 compared to that of 2008,

$46.6 million for PSSD inventories and $8.5 million for ISD inventories. Inventories decreased

$81.2 million during 2009 and $26.1 million during 2008. The larger decrease in 2009 was driven by

the Company’s increased focus on inventory management, particularly actions initiated during the second

quarter of 2009 to significantly reduce the production of supplies and purchases of printers, which lowered

the Company’s purchases during the period. These actions were taken in response to the challenging

economic conditions that negatively impacted the Company in the first quarter of 2009. The benefit of

these actions was maintained by the Company through fourth quarter of 2009 accompanied by stronger

than expected sales.

The reduction in Accounts payable balances was $32.3 million less in 2009 compared to that of 2008.

Accounts payable decreased $47.8 million during 2009 and $80.1 million during 2008. The smaller

reduction in 2009 was driven by the increase in demand in the fourth quarter of 2009, as well as favorable

payment terms implemented in the third quarter of 2009.

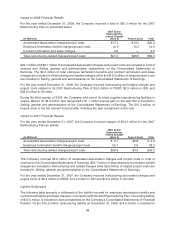

The decrease in Accrued liabilities and Other assets and liabilities, collectively, was $30.1 million less in

2009 compared to that of 2008, of which the largest single factor was income taxes. Income tax payments,

net of refunds received, were $41.3 million in 2009 compared to $97.8 million in 2008, a YTY decrease in

income taxes paid of $56.5 million. In 2009, the Company received approximately $25 million of refunds

from the IRS related to prior year tax payments. In 2008, the Company made a $21.8 million payment to the

IRS in settlement of the 2004-2005 income tax audit. In addition to income taxes, there were various other

items that contributed to the favorable YTY movement in Accrued liabilities and Other assets and liabilities

including both cash transactions as well as the effect of accruals of expected future operating cash receipts

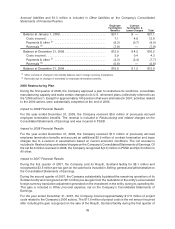

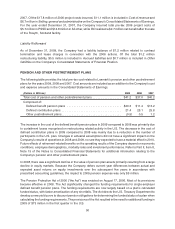

and payments. Other notable cash transactions, though offset by other activities, included pension and

postretirement funding and Germany copyright fee payments made in 2009. The Company made

$92.4 million of pension and postretirement payments in 2009 compared to $6.6 million in 2008 driven

by the steep decline in the fair value of pension plan assets in late 2008. The Company anticipates funding

an additional amount of approximately $20 million in 2010. Looking forward, the Company is currently

assuming pension and postretirement funding requirements for 2011 and 2012 of $30 million to $35 million

per year based on factors that were present as of December 31, 2009. Actual future pension and

postretirement funding requirements beyond 2010 will be impacted by various factors, including actual

pension asset returns and interest rates used for discounting future liabilities. The Company also made a

$43 million payment to German collection societies in the third quarter of 2009 in settlement of copyright

fees levied on all-in-one and multifunctional devices sold in Germany after December 31, 2001 through

December 31, 2007.

52