Lexmark 2009 Annual Report Download - page 119

Download and view the complete annual report

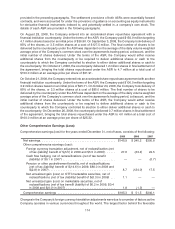

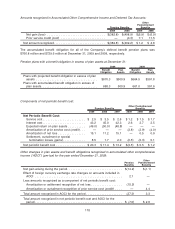

Please find page 119 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On November 10, 2005, the FASB issued accounting guidance on accounting for the tax effects of share-

based payment awards. The Company elected to adopt the alternative transition method provided in this

guidance for calculating the tax effects of stock-based compensation pursuant to the adoption of the share-

based payment guidance. The alternative transition method includes simplified methods to establish the

beginning balance of the additional paid-in capital pool (“APIC pool”) related to the tax effects of employee

stock-based compensation, and to determine the subsequent impact on the APIC pool and Consolidated

Statement of Cash Flows of the tax effects of employee stock-based compensation awards that are

outstanding upon the adoption of the share-based payment guidance.

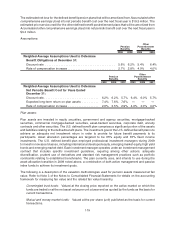

13. STOCKHOLDERS’ EQUITY AND OTHER COMPREHENSIVE EARNINGS (LOSS)

The Class A Common Stock is voting and exchangeable for Class B Common Stock in very limited

circumstances. The Class B Common Stock is non-voting and is convertible, subject to certain limitations,

into Class A Common Stock.

At December 31, 2009, there were 806.7 million shares of authorized, unissued Class A Common Stock.

Of this amount, approximately 18 million shares of Class A Common Stock have been reserved under

employee stock incentive plans and nonemployee director plans. There were also 1.8 million of unissued

and unreserved Class B Common Stock at December 31, 2009. These shares are available for a variety of

general corporate purposes, including future public offerings to raise additional capital and for facilitating

acquisitions.

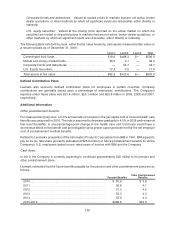

In 1998, the Company’s Board of Directors adopted a stockholder rights plan (the “Rights Plan”) which

provides existing stockholders with the right to purchase one one-thousandth (0.001) of a share of Series A

Junior Participating preferred stock for each share of Class A and Class B Common Stock held in the event

of certain changes in the Company’s ownership. The Rights Plan expired on January 31, 2009 without

modification.

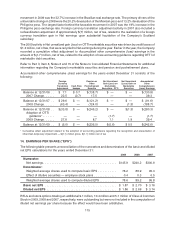

In May 2008, the Company received authorization from the Board of Directors to repurchase an additional

$0.75 billion of its Class A Common Stock for a total repurchase authority of $4.65 billion. As of

December 31, 2009, there was approximately $0.5 billion of share repurchase authority remaining.

This repurchase authority allows the Company, at management’s discretion, to selectively repurchase

its stock from time to time in the open market or in privately negotiated transactions depending upon

market price and other factors. The Company did not repurchase any shares of its Class A Common Stock

in 2009. During 2008, the Company repurchased approximately 17.5 million shares at a cost of

approximately $0.6 billion, including two accelerated share repurchase agreements discussed below.

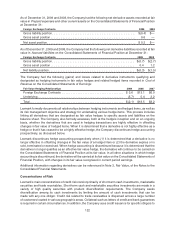

As of December 31, 2009, since the inception of the program in April 1996, the Company had repurchased

approximately 91.6 million shares for an aggregate cost of approximately $4.2 billion. As of December 31,

2009, the Company had reissued approximately 0.5 million shares of previously repurchased shares in

connection with certain of its employee benefit programs. As a result of these issuances as well as the

retirement of 44.0 million, 16.0 million and 16.0 million shares of treasury stock in 2005, 2006 and 2008,

respectively, the net treasury shares outstanding at December 31, 2009, were 15.1 million.

In December 2005, October 2006 and October 2008, the Company received authorization from the Board

of Directors to retire 44.0 million, 16.0 million and 16.0 million shares, respectively, of the Company’s

Class A Common Stock held in the Company’s treasury as treasury stock. The retired shares resumed the

status of authorized but unissued shares of Class A Common Stock. Refer to the Consolidated Statements

of Stockholders’ Equity and Comprehensive Earnings for the effects on Common stock,Capital in excess

of par,Retained earnings and Treasury stock from the retirement of 16.0 million shares of Class A

Common Stock in 2008.

Accelerated Share Repurchase Agreements

The Company executed two accelerated share repurchase agreements (“ASR”) with financial institution

counterparties in 2008, resulting in a total of 8.7 million shares repurchased at a cost of $250.0 million over

the third and fourth quarter of 2008. The impact of the two ASRs is included in the share repurchase totals

113