Lexmark 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.evaluated and whether such date is the date the financial statements were issued or the date the financial

statements were available to be issued. Lexmark, being a public company, evaluates subsequent events

through the date its financial statements are issued. FAS 165 was first effective for the Company’s second

quarter financial statements. Note 2 to the Consolidated Financial Statements provides the date through

which subsequent events were evaluated.

In June 2009, the FASB issued FAS No. 168, The FASB Accounting Standards Codification and the

Hierarchy of Generally Accepted Accounting Principles — a replacement of FASB Statement No. 162

(“FAS 168”). FAS 168 establishes the FASB Accounting Standards Codification (“ASC”) as the single

source of authoritative GAAP recognized by the FASB with the exception of guidance provided by the SEC

for public companies. Under the new accounting principles framework, if guidance for a transaction or

event is not specified within a source of authoritative GAAP, the Company must first consider accounting

principles for similar transactions or events within a source of authoritative GAAP and then consider

nonauthoritative guidance from other sources. Though the ASC is not intended to change existing GAAP,

any effect of applying the standard will be accounted for as a change in accounting principle or correction of

an error depending on the facts and circumstances. FAS 168 was first effective for the Company’s third

quarter financial statements. The Company has removed all other references to legacy accounting

standards and has adopted a plain English approach to disclosures regarding accounting guidance.

The Company expects no other changes to its financial statements as the result of the ASC. Changes to

the ASC, representing new or amended accounting and disclosure guidance, will be communicated in the

form of an Accounting Standards Update (“ASU”). Although ASUs will update the ASC, they are not

considered authoritative in their own right.

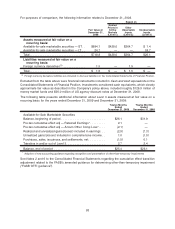

In August 2009, the FASB issued ASU No. 2009-05, Fair Value Measurements and Disclosures (Topic

820): Measuring Liabilities at Fair Value (“ASU 2009-05”). ASU 2009-05 reaffirms that the fair value

measurement of a liability is based on the assumption that the liability is transferred in an orderly

transaction to a market participant and continues to exist rather than settled with the counterparty. It

also reaffirms that the measurement include nonperformance risk and that such risk does not change after

the transfer of the liability. ASU 2009-05 provides guidance on how to measure liabilities at fair value. When

a quoted price in an active market for the identical liability is not available, a Level 1 measurement, an entity

must consider other technique(s). If the quoted price of an identical liability when traded as an asset in an

active market is available, and no adjustment is needed, this is also considered a Level 1 measurement. In

the absence of a Level 1 measurement, an entity must use one or more of the following: the quoted price of

the identical liability when traded as an asset, quoted prices for similar liabilities or similar liabilities when

traded as assets, and/or another valuation technique such as a technique based upon the amount an entity

would pay to transfer the identical liability in an orderly transaction or a technique based on the amount an

entity would receive to enter into an identical liability. An entity should not make a separate adjustment for

restrictions on the transfer of a liability when measuring the liability’s fair value. This restriction is implicit in

nearly all liabilities and is considered to be understood by issuer and creditor. However, quoted prices

should be adjusted for any factors specific to the asset that are not applicable to the fair value

measurement of the liability, such as the quoted price of an asset relates to a similar but not identical

liability or the quoted price of an asset includes the effect of a third-party guarantee. The method or

technique used to measure fair value must maximize the use of relevant observable inputs and should

reflect the assumptions that market participants would use in the principal or most advantageous market in

accordance with existing fair value guidance. The guidance was first effective for the Company in the fourth

quarter of 2009. There were no material changes to the Company’s fair value measurements resulting

from the new guidance.

In September 2009, the FASB issue ASU No. 2009-12, Fair Value Measurements and Disclosures (Topic

820): Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent) (“ASU

2009-12”). ASU 2009-12 applies to investments that both (1) do not have readily determinable fair values

and (2) are made to entities having all of the attributes of an investment company specified under current

U.S. GAAP or made to entities in which it is industry practice for the investee to issue financial statements

in a manner consistent with U.S. GAAP for investment companies. ASU 2009-12 provides guidance on the

78