Lexmark 2009 Annual Report Download - page 60

Download and view the complete annual report

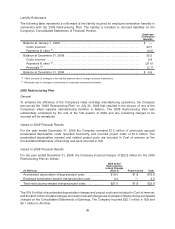

Please find page 60 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.pension contributions and the German copyright settlement discussed previously, that did not allow the

Company to invest these funds in marketable securities during the year. The YTY variations in cash flows

(used for) provided by investing activities were driven by the Company’s marketable securities investment

activities as well as the increase in capital expenditures discussed below.

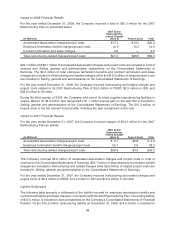

The Company’s investments in marketable securities are classified and accounted for as

available-for-sale. At December 31, 2009 and December 31, 2008, the Company’s marketable

securities portfolio consisted of asset-backed and mortgage-backed securities, corporate debt

securities, preferred and municipal debt securities, U.S. government and agency debt securities,

international government, commercial paper and certificates of deposit. The Company’s auction rate

securities, valued at $22.0 million and $24.7 at year-end 2009 and 2008, respectively, are reported in the

noncurrent assets section of the Company’s Consolidated Statements of Financial Position.

For the year ended December 31, 2009, the Company recognized $2.7 million in net losses on its

marketable securities, including $3.3 million for other-than-temporary impairment (“OTTI”) of debt

securities. Of the total OTTI charges, $3.1 million were recorded in Net Impairment Losses on

Securities and calculated in accordance with the new FASB OTTI guidance and $0.2 million were

recognized in Other (income) expense, net in the first quarter of 2009 as determined under the prior

OTTI guidance. The Company assesses its marketable securities for other-than-temporary declines in

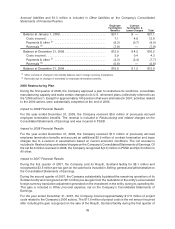

value in accordance with the new model provided under the FASB’s amended guidance, which was

adopted in the second quarter of 2009. The Company has disclosed in the Critical Accounting Policies and

Estimates portion of Management’s Discussion and Analysis its policy regarding the factors it considers

and significant judgments made in applying the new guidance. Of the $3.1 million total above,

approximately $1.2 million were related to Lehman Brothers debt securities credit losses and

$1.4 million represent credit losses recognized for one of the Company’s municipal auction rate

securities. It should be noted that all of the 2009 charges related to Lehman Brothers and $0.7 million

of the 2009 charge related to the municipal auction rate security are recycled charges that were recognized

in 2008 and partially reversed through Retained earnings on April 1, 2009 in the transition adjustment

required under the amended FASB OTTI guidance. The majority, but not all, of the OTTI charges in 2009

were related to assets deemed Level 3 in the fair value hierarchy and are included in the Level 3 disclosures

provided in Part II, Item 8, Note 3 of the Notes to Consolidated Financial Statements. In addition, at

December 31, 2009, the Company recognized a cumulative, pre-tax valuation allowance of $0.9 million

included in Accumulated other comprehensive loss on the Consolidated Statements of Financial Position,

representing a temporary impairment of the overall portfolio. The pre-tax valuation allowance consists of

gross unrealized losses of $4.4 million, primarily related to certain asset-backed and mortgage-backed

securities and auction rate securities, offset partially by $3.5 million of gross unrealized holding gains

related to various types of securities.

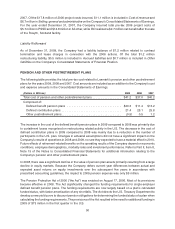

For the year ended December 31, 2008, the Company recognized $7.9 million in net losses on its

marketable securities, including $7.3 million for other-than-temporary impairment of debt securities held

by the Company on December 31, 2008, under the OTTI accounting guidance effective at that time. In

2008 there were several significant market events, including the bankruptcy of Lehman Brothers Holdings

and the failed auctions of many of the Company’s auction rate securities. In 2008, Lexmark transferred its

Lehman Brothers corporate debt securities into the Level 3 category of the fair value hierarchy, and

subsequently took a charge of $4.4 million based on the estimated fair value of the investments determined

from indicative pricing sources. Additionally in 2008, the Company recognized a $1.9 million charge for

other-than-temporary impairment in connection with its auction rate fixed income securities; the fair value

of which was determined using an internal discount cash flow valuation model discussed later in this

section. The Company also incurred another $1.0 million of charges related to other-than-temporary

impairments of certain distressed corporate debt, mortgage-backed and asset-backed securities. The

$7.3 million in total losses were recognized in Other (income) expense, net on the Consolidated

Statements of Earnings and included in the Company’s Level 3 rollforward table in Part II, Item 8,

Note 3 of the Notes to Consolidated Financial Statements. In addition, at December 31, 2008, the

Company recognized a cumulative, pre-tax valuation allowance of $1.7 million included in Accumulated

54