Lexmark 2009 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

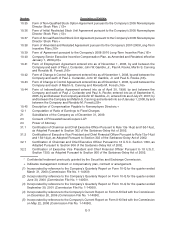

Index to Exhibits

Number Description of Exhibits

2 Agreement and Plan of Merger, dated as of February 29, 2000, by and between Lexmark

International, Inc. (the “Company”) and Lexmark International Group, Inc.(1)

3.1 Restated Certificate of Incorporation of the Company.(2)

3.2 Company By-Laws, as Amended and Restated June 22, 2000.(2)

3.3 Amendment No. 1, dated as of July 26, 2001, to Company By-Laws, as Amended and Restated

June 22, 2000.(3)

3.4 Amendment No. 2, dated as of December 20, 2006, to Company By-Laws, as Amended and

Restated June 22, 2000.(4)

4.1 Form of Indenture, dated as of May 22, 2008, between the Company and The Bank of New York

Trust Company, N.A., as Trustee.(5)

4.2 Form of First Supplemental Indenture, dated as of May 22, 2008, between the Company and The

Bank of New York Trust Company, N.A., as Trustee.(5)

4.3 Form of Global Note of the Company’s 5.900% Senior Notes due 2013 (included in

Exhibit 4.2).(5)

4.4 Form of Global Note of the Company’s 6.650% Senior Notes due 2018 (included in

Exhibit 4.2).(5)

4.5 Specimen of Class A Common Stock Certificate.(2)

10.1 Agreement, dated as of May 31, 1990, between the Company and Canon Inc., and Amendment

thereto.(6)*

10.2 Agreement, dated as of March 26, 1991, between the Company and Hewlett-Packard

Company.(6)*

10.3 Patent Cross-License Agreement, effective October 1, 1996, between Hewlett-Packard

Company and the Company.(7)*

10.4 Amended and Restated Lease Agreement, dated as of January 1, 1991, between IBM and the

Company, and First Amendment, dated as of March 1, 1991, thereto.(8)

10.5 Third Amendment to Lease Agreement, dated as of December 28, 2000, between IBM and the

Company.(9)

10.6 Credit Agreement, dated as of August 17, 2009, by and among the Company, as Borrower, the

Lenders party thereto, JPMorgan Chase Bank, N.A., as Administrative Agent, Bank of America,

N.A., as Syndication Agent, and Citibank, N.A. and SunTrust Bank, as Co-Documentation

Agents.(10)

10.7 Amended and Restated Receivables Purchase Agreement, dated as of October 8, 2004, by and

among Lexmark Receivables Corporation (“LRC”), as Seller, CIESCO, LLC and Gotham

Funding Corporation (“Gotham”), as the Investors, Citibank, N.A. and The Bank of Tokyo-

Mitsubishi, Ltd., New York Branch (“BTM”), as the Banks, Citicorp North America, Inc.

(“CNAI”) and BTM, as the Investor Agents, CNAI, as Program Agent for the Investors and

Banks, and the Company, as Collection Agent and Originator.(11)

10.8 Amendment No. 1 to Receivables Purchase Agreement, dated as of October 7, 2005, by and

among LRC, as Seller, CIESCO, LLC, Gotham, Citibank, N.A., BTM, and CNAI, as Program

Agent, CNAI and BTM, as Investor Agents, and the Company, as Collection Agent and

Originator.(12)

10.9 Amendment No. 2 to Receivables Purchase Agreement, dated as of October 6, 2006, by and

among LRC, as Seller, CIESCO, LLC and Gotham, as the Investors, Citibank, N.A. and The Bank

of Tokyo-Mitsubishi UFJ, Ltd., New York Branch (“BTMUFJ”), CNAI, as Program Agent, CNAI

and BTMUFJ, as Investor Agents, and the Company, as Collection Agent and Originator.(13)

10.10 Amendment No. 3 to Receivables Purchase Agreement, dated as of March 30, 2007, by and

among LRC, as Seller, CIESCO, LLC and Gotham, as the Investors, Citibank, N.A. and BTMUFJ,

CNAI, as Program Agent, CNAI and BTMUFJ, as Investor Agents, and the Company, as

Collection Agent and Originator.(14)

E-1