Lexmark 2009 Annual Report Download - page 92

Download and view the complete annual report

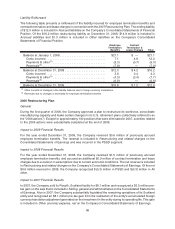

Please find page 92 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.with respect to the consensus pricing methodology used in the valuation of these securities. The Company

has implemented more comprehensive procedures to review the number of pricing inputs received as well

as the variability in the pricing data utilized in the overall valuation. For securities in which the number of

pricing inputs used is less than expected or there is significant variability in the pricing inputs, the Company

has tested that the final consensus price is within a reasonable range of fair value through corroboration

with other sources of price data.

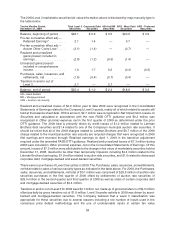

During 2009, the Company valued certain mortgage-backed and asset-backed securities using a

discounted cash flow approach rather than the consensus price method described above. The

additional valuation was performed during the Company’s assessment of other-than-temporary

impairment under the new model included in the FASB OTTI guidance. Under the discounted cash

flow approach, collateral-specific assumptions were developed based on an analysis of the characteristics

of each security. These assumptions were then used to project the performance of the instruments. The

expected cash flows that resulted from the analysis were then discounted using a rate intended to reflect

the uncertainty inherent in the cash flows. In some cases, the Company was able to corroborate the results

of the discounted cash flow analysis with the valuations determined under the consensus pricing method

within a reasonable range of fair value. The corroborated fair values were maintained as Level 2 within the

fair value hierarchy.

Level 2 fair value measurements also include smaller amounts of commercial paper and certificates of

deposit which generally have shorter maturities and less frequent market trades. Such securities are

valued via mathematical calculations using observable inputs until such time that market activity reflects

an updated price.

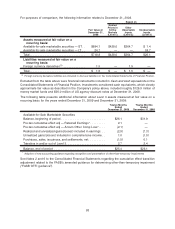

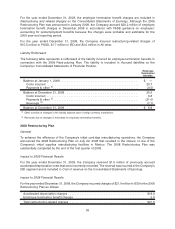

Level 3 — Marketable Securities

Level 3 fair value measurements are based on inputs that are unobservable and significant to the overall

valuation. Level 3 fair value measurements at December 31, 2009 included auction rate securities for

which recent auctions were unsuccessful, valued at $22.0 million, as well as certain distressed debt

securities and other asset-backed and mortgage-backed securities valued at $3.4 million. The auction rate

securities were made up of student loan revenue bonds valued at $13.7 million, municipal sewer and

airport revenue bonds valued at $4.9 million, and auction preferred stock valued at $3.4 million at year end

2009. Level 3 fair value measurements at December 31, 2008 included auction rate securities for which

recent auctions were unsuccessful, valued at $24.7 million, certain distressed debt instruments valued at

$0.8 million, and other thinly traded corporate debt securities and mortgage-backed securities valued at

$0.6 million. The auction rate securities were made up of student loan revenue bonds valued at

$14.6 million, municipal sewer and airport revenue bonds valued at $6.2 million, and auction rate

preferred stock valued at $3.9 million. The valuation techniques for the Company’s level 3 fair value

measurements of its marketable securities are discussed in the paragraphs to follow.

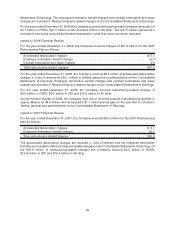

Auction Rate Securities

For year-end 2009, the Company’s auction rate securities for which recent auctions were unsuccessful

were valued using a more refined discounted cash flow model that places greater emphasis on the

characteristics of the individual securities, which the Company believes yields a better estimate of fair

value. The first step in the valuation included a credit analysis of the security which considered various

factors including the credit quality of the issuer (and insurer if applicable), the instrument’s position within

the capital structure of the issuing authority, and the composition of the authority’s assets including the

effect of insurance and/or government guarantees. Next, the future cash flows of the instruments were

projected based on certain assumptions significant to the valuation including (1) the auction rate market

will remain illiquid and auctions will continue to fail causing the interest rate to be the maximum applicable

rate and (2) the securities will not be redeemed. These assumptions resulted in discounted cash flow

analysis being performed through the legal maturities of these securities, ranging from the year 2032

through 2040, or in the case of the auction rate preferred stock, through the mandatory redemption date of

year-end 2021. The projected cash flows were then discounted using the applicable yield curve, such as

86