Lexmark 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

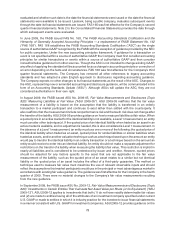

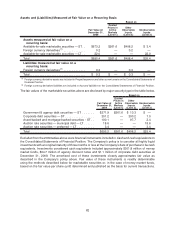

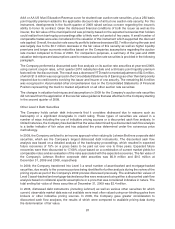

Assets and (Liabilities) Measured at Fair Value on a Recurring Basis

Fair Value At

December 31,

2009

Quoted

Prices in

Active

Markets

(Level 1)

Other

Observable

Inputs

(Level 2)

Unobservable

Inputs

(Level 3)

Based on

Assets measured at fair value on a

recurring basis:

Available-for-sale marketable securities — ST . . $673.2 $261.6 $408.2 $ 3.4

Foreign currency derivatives

(1)

............. 0.2 — 0.2 —

Available-for-sale marketable securities — LT . . 22.0 — — 22.0

Total................................. $695.4 $261.6 $408.4 $25.4

Liabilities measured at fair value on a

recurring basis:

Foreign currency derivatives

(2)

............. 0.3 — 0.3 —

Total................................. $ 0.3 $ — $ 0.3 $ —

(1)

Foreign currency derivative assets are included in Prepaid expenses and other current assets on the Consolidated Statements of

Financial Position.

(2)

Foreign currency derivative liabilities are included in Accrued liabilities on the Consolidated Statements of Financial Position.

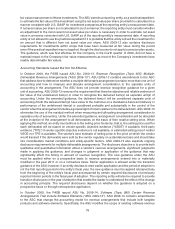

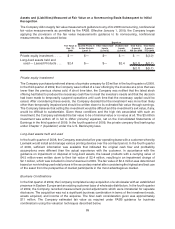

The fair values of the marketable securities above are disclosed by major security type in the table below.

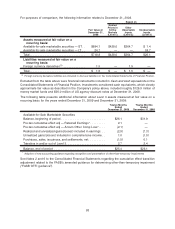

Fair Value at

December 31,

2009

Quoted

Prices in

Active

Markets

(Level 1)

Other

Observable

Inputs

(Level 2)

Unobservable

Inputs

(Level 3)

Based on

Government & agency debt securities — ST . . . . . . . $271.9 $261.6 $ 10.3 $ —

Corporate debt securities — ST . . . . . . . . . . . . . . . . . 301.2 — 300.2 1.0

Asset-backed and mortgage-backed securities - ST . . 100.1 — 97.7 2.4

Auction rate securities — municipal debt — LT . . . . . . 18.6 — — 18.6

Auction rate securities — preferred — LT . . . . . . . . . . 3.4 — — 3.4

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $695.2 $261.6 $408.2 $25.4

Excluded from the 2009 tables above were financial instruments included in Cash and cash equivalents on

the Consolidated Statements of Financial Position. The Company’s policy is to consider all highly liquid

investments with an original maturity of three months or less at the Company’s date of purchase to be cash

equivalents. Investments considered cash equivalents included approximately $301.8 million of money

market funds, $34.7 million of agency discount notes and $1.1 million of corporate debt securities at

December 31, 2009. The amortized cost of these investments closely approximates fair value as

described in the Company’s policy above. Fair value of these instruments is readily determinable

using the methods described below for marketable securities or, in the case of money market funds,

based on the fair value per share (unit) determined and published as the basis for current transactions.

82