Lexmark 2009 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

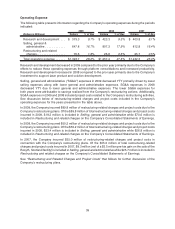

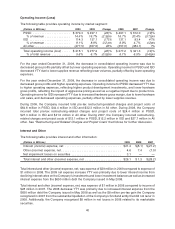

Operating Expense

The following table presents information regarding the Company’s operating expenses during the periods

indicated:

(Dollars in Millions) Dollars % of Rev Dollars % of Rev Dollars % of Rev

2009 2008 2007

Research and development . . . $ 375.3 9.7% $ 423.3 9.3% $ 403.8 8.1%

Selling, general &

administrative . . . . . . . . . . . . 647.8 16.7% 807.3 17.9% 812.8 16.4%

Restructuring and related

charges. . . . . . . . . . . . . . . . . 70.6 1.8% 26.8 0.6% 25.7 0.5%

Total operating expense . . . . . . $1,093.7 28.2% $1,257.4 27.8% $1,242.3 25.0%

Research and development decreased in 2009 compared to the prior year primarily due to the Company’s

efforts to reduce these operating expenses through platform consolidations and increased productivity.

Research and development increased in 2008 compared to the prior year primarily due to the Company’s

investment to support laser product and solution development.

Selling, general and administrative (“SG&A”) expenses in 2009 decreased YTY primarily driven by lower

selling expenses along with lower general and administrative expenses. SG&A expenses in 2008

decreased YTY due to lower general and administrative expenses. The lower SG&A expenses for

both years were attributable to savings realized from the Company’s restructuring actions. Additionally,

SG&A expenses in 2009 and 2008 included project costs related to the Company’s restructuring activities.

See discussion below of restructuring-related charges and project costs included in the Company’s

operating expenses for the years presented in the table above.

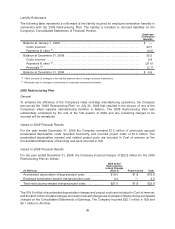

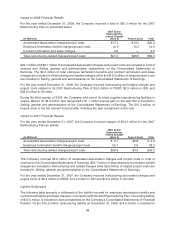

In 2009, the Company incurred $89.8 million of restructuring-related charges and project costs due to the

Company’s restructuring plans. Of the $89.8 million of total restructuring-related charges and project costs

incurred in 2009, $19.2 million is included in Selling, general and administrative while $70.6 million is

included in Restructuring and related charges on the Company’s Consolidated Statements of Earnings.

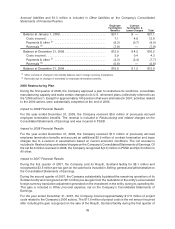

In 2008, the Company incurred $50.2 million of restructuring-related charges and project costs due to the

Company’s restructuring plans. Of the $50.2 million of total restructuring-related charges and project costs

incurred in 2008, $23.4 million is included in Selling, general and administrative while $26.8 million is

included in Restructuring and related charges on the Company’s Consolidated Statements of Earnings.

In 2007, the Company incurred $35.0 million of restructuring-related charges and project costs in

connection with the Company’s restructuring plans. Of the $35.0 million of total restructuring-related

charges and project costs incurred in 2007, $9.3 million (net of a $3.5 million pre-tax gain on the sale of the

Rosyth, Scotland facility) is included in Selling, general and administrative while $25.7 million is included in

Restructuring and related charges on the Company’s Consolidated Statements of Earnings.

See “Restructuring and Related Charges and Project Costs” that follows for further discussion of the

Company’s restructuring plans.

39