Lexmark 2009 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

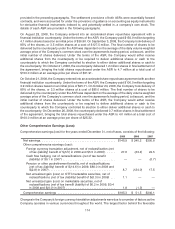

movement in 2009 was the 32.7% increase in the Brazilian real exchange rate. The primary drivers of the

unfavorable change in 2008 were the 20.2% devaluation of the Mexican peso and 13.2% devaluation of the

Philippine peso. The largest factor behind the favorable movement in 2007 was the 19% increase in the

Philippine peso exchange rate. Foreign currency translation adjustment activity in 2007 also included a

reclassification adjustment of approximately $(7) million, net of tax, related to the realization of a foreign

currency translation gain in Net earnings upon substantial liquidation of the Company’s Scotland

subsidiary.

The 2009 activity in Net unrealized gain (loss) on OTTI marketable securities was driven by credit losses of

$1.4 million, net of tax, that were recycled to Net earnings during the year. Earlier in the year, the Company

recorded a cumulative effect adjustment to Accumulated other comprehensive (loss) earnings in the

amount of $(1.7) million, net of tax, related to the adoption of new accounting guidance regarding OTTI of

marketable debt securities.

Refer to Part II, Item 8, Notes 6 and 15 of the Notes to Consolidated Financial Statements for additional

information regarding the Company’s marketable securities and pension and postretirement plans.

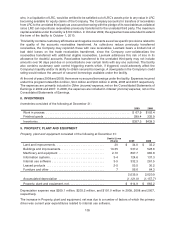

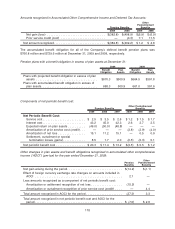

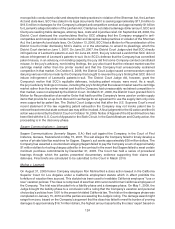

Accumulated other comprehensive (loss) earnings for the years ended December 31 consists of the

following:

Foreign

Currency

Translation

Adjustment

Cash Flow

Hedges

Pension or

Other

Postretirement

Benefits

Net Unrealized

Gain (Loss) on

Marketable

Securities - OTTI

Net Unrealized

(Loss) Gain on

Marketable

Securities

Accumulated

Other

Comprehensive

(Loss) Earnings

Balance at 12/31/06 . . $ 7.1 $ 0.7 $(138.7) $ — $ — $(130.9)

2007 Change . . . . . . 22.5 (0.7) 17.5 — — 39.3

Balance at 12/31/07 . . $ 29.6 $ — $(121.2) $ — $ — $ (91.6)

2008 Change . . . . . . (63.4) — (124.0) — (1.3) (188.7)

Balance at 12/31/08 . . $(33.8) $ — $(245.2) $ — $(1.3) $(280.3)

Adoption of OTTI

guidance* . . . . . . . — — — (1.7) — (1.7)

2009 Change . . . . . . 27.8 — 8.7 1.1 1.8 39.4

Balance at 12/31/09 . . $ (6.0) $ — $(236.5) $(0.6) $ 0.5 $(242.6)

* Cumulative effect adjustment related to the adoption of accounting guidance regarding the recognition and presentation of

other-than-temporary impairment — $(2.1) million gross, $(1.7) million net of tax

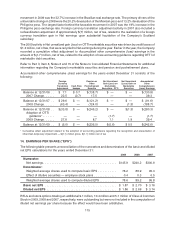

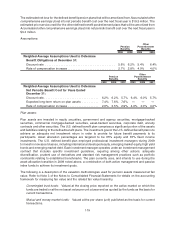

14. EARNINGS PER SHARE (“EPS”)

The following table presents a reconciliation of the numerators and denominators of the basic and diluted

net EPS calculations for the years ended December 31:

2009 2008 2007

Numerator:

Net earnings. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $145.9 $240.2 $300.8

Denominator:

Weighted average shares used to compute basic EPS . . . . . . . . . . . 78.2 88.9 95.3

Effect of dilutive securities — employee stock plans . . . . . . . . . . . . . 0.4 0.3 0.5

Weighted average shares used to compute diluted EPS . . . . . . . . . . 78.6 89.2 95.8

Basic net EPS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1.87 $ 2.70 $ 3.16

Diluted net EPS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1.86 $ 2.69 $ 3.14

RSUs and stock options totaling an additional 9.1 million, 10.4 million and 5.1 million of Class A Common

Stock in 2009, 2008 and 2007, respectively, were outstanding but were not included in the computation of

diluted net earnings per share because the effect would have been antidilutive.

115