Lexmark 2009 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

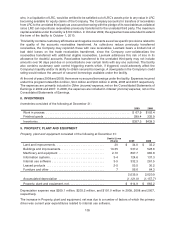

Leased products refers to hardware leased by Lexmark to certain customers as part of the Company’s

PSSD operations. The cost of the hardware is amortized over the life of the contracts, which have been

classified as operating leases based on the terms of the arrangements. The accumulated depreciation

related to the Company’s leased products was $27.8 million and $11.0 million at year-end 2009 and 2008,

respectively.

Accelerated depreciation and disposal of long-lived assets

The Company’s restructuring actions have resulted in shortened estimated useful lives of certain

machinery and equipment and buildings and subsequent disposal of machinery and equipment no

longer in use. Refer to Part II, Item 8, Note 4 of the Notes to Consolidated Financial Statements for a

discussion of these actions and the impact on earnings.

Long-lived assets held for sale

Related to the 2008 restructuring plan, one of the Company’s inkjet supplies manufacturing facilities in

Mexico was made available for sale in the first quarter of 2009. The asset is included in Property, plant and

equipment, net on the Consolidated Statement of Financial Position as of December 31, 2009 at the lower

of its carrying amount or fair value less costs to sell in accordance with guidance on accounting for the

impairment or disposal of long-lived assets. The carrying value of the building and land available for sale

was approximately $5 million at December 31, 2009. It is estimated that the fair value of the site is

approximately $6 million based on the conditional sale agreement signed by the Company and a potential

buyer in the fourth quarter of 2009. In the prior quarter, it was estimated that the fair value of the site was

approximately $7 million based on an average of the fair values calculated under the income approach and

market approach. The income approach was based on a hypothetical leasing arrangement which

considered a regional rental market price per square foot assumption as well as a five year customary

lease term. The market approach was based on adjusted prices for sales of realty considered comparable

to the site. The Company used the deposit method of accounting for the initial investment of $0.8 million

received from the buyer and anticipates derecognizing the asset in the second quarter of 2010 based on

the agreed upon payment schedule. There were no fair value adjustments recorded in 2009 related to the

site made available for sale.

Related to the 2007 restructuring plan, the Company’s Orleans, France facility was made available for sale

in the second quarter of 2009. The asset is included in Property, plant and equipment, net on the

Consolidated Statements of Financial Position as of December 31, 2009 at the lower of its carrying amount

or fair value less costs to sell in accordance with guidance on accounting for the impairment or disposal of

long-lived assets. At the completion of the accelerated depreciation, the facility’s carrying value was

approximately $7 million upon qualifying as held for sale. The fair value of the site is estimated to be in the

range of $7 million to $8 million based on non-binding price quotes from a market participant and

considering the highest and best use of the asset for sale. The Company believes it will likely sell the facility

in 2010.

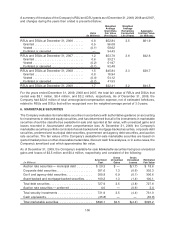

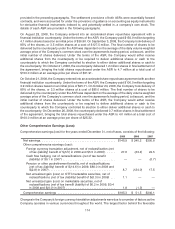

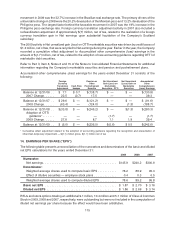

10. ACCRUED LIABILITIES AND OTHER LIABILITIES

Accrued liabilities, in the current liabilities section of the balance sheet, consisted of the following at

December 31:

2009 2008

Deferred revenue. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $119.7 $ 95.0

Compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 111.8 114.6

Copyright fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 69.9 117.7

Marketing programs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 69.8 70.4

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 310.5 297.2

Accrued liabilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $681.7 $694.9

106