Lexmark 2009 Annual Report Download - page 82

Download and view the complete annual report

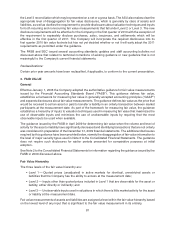

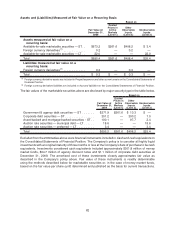

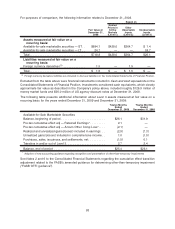

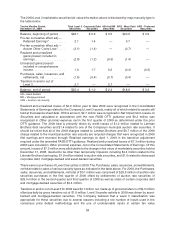

Please find page 82 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Accumulated Other Comprehensive (Loss) Earnings:

Accumulated other comprehensive (loss) earnings refers to revenues, expenses, gains and losses that

under accounting principles generally accepted in the U.S. are included in comprehensive earnings (loss)

but are excluded from net income as these amounts are recorded directly as an adjustment to

stockholders’ equity, net of tax. Lexmark’s Accumulated other comprehensive (loss) earnings is

composed of deferred gains and losses related to pension or other postretirement benefits, foreign

currency exchange rate adjustments, and net unrealized gains and losses on marketable securities

including the non-credit loss component of OTTI beginning in 2009 based on new accounting guidance.

Segment Data:

Lexmark manufactures and sells a variety of printing and multifunction products and related supplies and

services and is primarily managed along divisional lines: the Printing Solutions and Services Division

(“PSSD”) and the Imaging Solutions Division (“ISD”).

Subsequent Events:

The Company performs an evaluation of subsequent events through the date the financial statements are

issued. The Company’s year-end 2009 financial statements were issued on February 26, 2010.

Recent Accounting Pronouncements:

In April 2009, the FASB issued FASB Staff Position (“FSP”) No. FAS 141(R)-1, Accounting for Assets

Acquired and Liabilities Assumed in a Business Combination That Arise from Contingencies (“FSP

FAS 141(R)-1”). The FSP amends the guidance provided under FAS 141(R) Business Combinations

(“FAS 141(R)”) with regard to assets and liabilities arising from contingencies in a business combination.

The new FSP requires that the acquirer recognize pre-acquisition contingencies at fair value if the

acquisition-date fair value can be reasonably determined during the measurement period. If fair value

cannot be reasonably determined, the measurement should be based on the best estimate in accordance

with the guidance on accounting for contingencies. The FSP was effective for acquisitions by the Company

beginning in the first quarter of 2009. The Company applied this guidance to its single acquisition during

2009, described in Note 3 to the Consolidated Financial Statements.

In April 2009, the FASB issued FSP No. FAS 157-4, Determining Fair Value When the Volume and Level of

Activity for the Asset or Liability Have Significantly Decreased and Identifying Transactions That Are Not

Orderly (“FSP FAS 157-4”). This FSP amends FAS 157, Fair Value Measurements (“FAS 157”) and

supersedes FSP No. FAS 157-3, Determining the Fair Value of a Financial Asset When the Market for That

Asset is Not Active (“FSP FAS 157-3”). According to the FSP, an entity should consider several factors to

determine whether there has been a significant decrease in the volume and level of activity for the asset or

liability when compared with normal market activity for the asset or liability including price quotations not

based on current information, few number of recent transactions, and price quotations varying

substantially among market makers to name a few. If an entity concludes, based on the weight of the

evidence, there has been a significant decrease in volume and level of activity then transactions or quoted

prices may not be determinative of fair value, thus requiring further analysis to determine whether the

prices are based on orderly transactions. The FSP lists several factors to consider in making this

assessment as well, including the existence of a usual and customary marketing period, the seller

being in or near bankruptcy or forced to sell to meet regulatory or legal requirements, and the transaction

price appearing as an outlier when compared with other recent transactions. Based on the available

evidence, an entity must determine whether or not a transaction is orderly. The weight placed on a

transaction price when estimating fair value is based on this determination as well as the sufficiency of

information available to make the determination. The FSP reaffirms the need to use judgment when

determining if a price is determinative of fair value, considering all facts and circumstances including the

nature of a quote (binding offer or an indicative price), whether or not the price includes an appropriate risk

premium that a market participant would demand, and considering the use of a different valuation

76