Lexmark 2009 Annual Report Download - page 80

Download and view the complete annual report

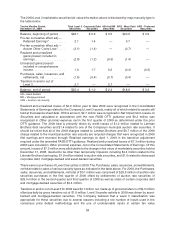

Please find page 80 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.other comprehensive earnings of certain gains and losses that arise during the period, but are deferred

under pension accounting rules.

Stock-Based Compensation:

On January 1, 2006, the Company implemented the provisions of FASB guidance on share-based

payment and related interpretations. This guidance requires that all share-based payments to

employees, including grants of stock options, be recognized in the financial statements based on their

fair value. The Company selected the modified prospective transition method for implementing this

guidance and began recognizing compensation expense for stock-based awards granted on or after

January 1, 2006, plus any unvested awards granted prior to January 1, 2006. Stock-based compensation

expense for awards granted on or after January 1, 2006, is based on the grant date fair value calculated in

accordance with the provisions of the share-based payment accounting guidance. Stock-based

compensation related to any unvested awards granted prior to January 1, 2006, is based on the grant

date fair value calculated in accordance with the original provisions of FASB guidance on accounting for

stock-based compensation. The fair value of the Company’s stock-based awards, less estimated

forfeitures, is amortized over the awards’ vesting periods on a straight-line basis if the awards have a

service condition only. For awards that contain a performance condition, the fair value of these stock-

based awards, less estimated forfeitures, is amortized over the awards’ vesting periods using the graded

vesting method of expense attribution.

The fair value of each option award on the grant date was estimated using the Black-Scholes option-pricing

model with the following assumptions: expected dividend yield, expected stock price volatility, weighted

average risk-free interest rate and weighted average expected life of the options. Under the accounting

guidance on share-based payment, the Company’s expected volatility assumption used in the Black-

Scholes option-pricing model was based exclusively on historical volatility and the expected life

assumption was established based upon an analysis of historical option exercise behavior. The risk-

free interest rate used in the Black-Scholes model was based on the implied yield currently available on

U.S. Treasury zero-coupon issues with a remaining term equal to the Company’s expected term

assumption. The Company has never declared or paid any cash dividends on the Class A Common

Stock and has no current plans to pay cash dividends on the Class A Common Stock. The payment of any

future cash dividends will be determined by the Company’s Board of Directors in light of conditions then

existing, including the Company’s earnings, financial condition and capital requirements, restrictions in

financing agreements, business conditions, tax laws, certain corporate law requirements and various other

factors. The fair value of each restricted stock unit award and deferred stock unit award was generally

calculated using the closing price of the Company’s stock on the date of grant.

Restructuring:

Lexmark records a liability for a cost associated with an exit or disposal activity at its fair value in the period

in which the liability is incurred, except for liabilities for certain employee termination benefit charges that

are accrued over time. Employee termination benefits associated with an exit or disposal activity are

accrued when the obligation is probable and estimable as a postemployment benefit obligation when local

statutory requirements stipulate minimum involuntary termination benefits or, in the absence of local

statutory requirements, termination benefits to be provided are similar to benefits provided in prior

restructuring activities. Specifically for termination benefits under a one-time benefit arrangement, the

timing of recognition and related measurement of a liability depends on whether employees are required to

render service until they are terminated in order to receive the termination benefits and, if so, whether

employees will be retained to render service beyond a minimum retention period. For employees who are

not required to render service until they are terminated in order to receive the termination benefits or

employees who will not provide service beyond the minimum retention period, the Company records a

liability for the termination benefits at the communication date. If employees are required to render service

until they are terminated in order to receive the termination benefits and will be retained to render service

beyond the minimum retention period, the Company measures the liability for termination benefits at the

74