Kraft 2012 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2012 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

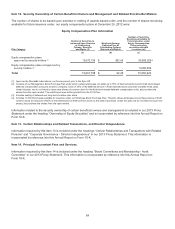

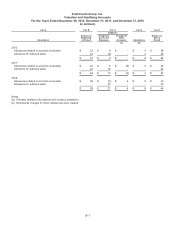

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

The number of shares to be issued upon exercise or vesting of awards issued under, and the number of shares remaining

available for future issuance under, our equity compensation plans at December 29, 2012 were:

Equity Compensation Plan Information

Plan Category

Number of Securities to

be Issued Upon Exercise

of Outstanding

Options, Warrants

and Rights (3)

Weighted-Average

Exercise Price of

Outstanding Options,

Warrants and Rights

Number of Securities

Remaining Available for

Future Issuance under

Equity Compensation

Plans (excluding

securities reflected

in column (a))

(a) (b) (c)

Equity compensation plans

approved by security holders (1) 19,672,738 $ $32.45 56,955,320(4)

Equity compensation plans not approved by

security holders (2) - - 5,000,000

Total 19,672,738 $ 32.45 61,955,320

(1) Approved by Mondele¯ z International, our former parent, prior to the Spin-Off.

(2) Consists of our Management Stock Purchase Plan under which certain employees can defer up to 50% of their annual bonus into Kraft stock-based

deferred compensation units and receive a company match of 25% of the deferred amount in Kraft restricted stock units that vest after three years.

Under this plan, we do not intend to issue new shares of common stock for the Kraft stock-based deferred compensation units, but purchase the

shares from the open market. The matching shares will be granted from the 2012 Plan.

(3) Includes vesting of deferred and long-term incentive plan stock.

(4) Includes 11,500,000 shares available for issuance under our Employee Stock Purchase Plan. This plan allows employees to purchase shares of Kraft

common stock at a discount of 85% of the market price of Kraft common stock on the date of purchase. Under this plan, we do not intend to issue new

shares, but purchase the shares from the open market.

Information related to the security ownership of certain beneficial owners and management is included in our 2013 Proxy

Statement under the heading “Ownership of Equity Securities” and is incorporated by reference into this Annual Report on

Form 10-K.

Item 13. Certain Relationships and Related Transactions, and Director Independence.

Information required by this Item 13 is included under the headings “Certain Relationships and Transactions with Related

Persons” and “Corporate Governance - Director Independence” in our 2013 Proxy Statement. This information is

incorporated by reference into this Annual Report on Form 10-K.

Item 14. Principal Accountant Fees and Services.

Information required by this Item 14 is included under the heading “Board Committees and Membership - Audit

Committee” in our 2013 Proxy Statement. This information is incorporated by reference into this Annual Report on

Form 10-K.

84