Kraft 2012 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2012 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

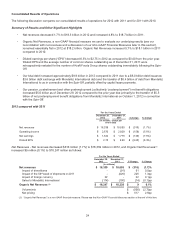

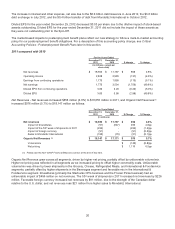

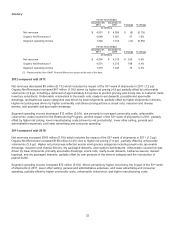

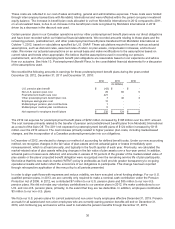

Refrigerated Meals

For the Years Ended

December 29,

2012

December 31,

2011 $ change % change

(in millions)

Net revenues $ 3,296 $ 3,328 $ (32) (1.0%)

Organic Net Revenues (1) 3,296 3,285 11 0.3%

Segment operating income 379 319 60 18.8%

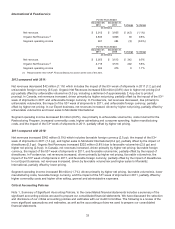

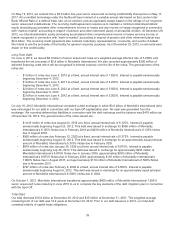

For the Years Ended

December 31,

2011

December 31,

2010 $ change % change

(in millions)

Net revenues $ 3,328 $ 3,131 $ 197 6.3%

Organic Net Revenues (1) 3,285 3,131 154 4.9%

Segment operating income 319 268 51 19.0%

(1) Please see the Non-GAAP Financial Measures section at the end of this item.

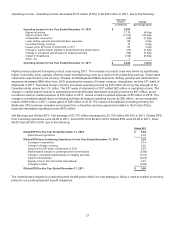

2012 compared with 2011:

Net revenues decreased $32 million (1.0%) which includes the impact of the 53rd week of shipments in 2011 (1.3 pp).

Organic Net Revenues increased $11 million (0.3%) due to higher net pricing (1.6 pp), partially offset by unfavorable

volume/mix (1.3 pp, including a detriment of approximately 0.7 pp due to product pruning). Unfavorable volume/mix was

driven primarily by pruning of certain meat products and lower shipments in hot dogs, partially offset by favorable mix in

cold cuts. Higher net pricing was due to commodity cost-driven pricing primarily related to lunch combinations and hot

dogs.

Segment operating income increased $60 million (18.8%), driven primarily by higher net pricing, lower other selling,

general and administrative expenses, and lower manufacturing costs (driven by net productivity), partially offset by costs

incurred for the Restructuring Program, increased commodity costs, higher advertising and consumer spending, the

impact of the 53rd week of shipments in 2011, and unfavorable volume/mix.

2011 compared with 2010:

Net revenues increased $197 million (6.3%) which includes the impact of the 53rd week of shipments in 2011 (1.4pp).

Organic Net Revenues increased $154 million (4.9%) due to higher net pricing (6.7 pp), partially offset by unfavorable

volume/mix (1.8 pp). Higher net pricing was driven by bacon, cold cuts, hot dogs, and lunch combinations. Unfavorable

volume/mix was due primarily to lower shipments in bacon and hot dogs, partially offset by higher shipments in cold cuts

and lunch combinations.

Segment operating income increased $51 million (19.0%), due primarily to higher net pricing, lower other selling, general

and administrative expenses, lower manufacturing costs, and the impact of the 53rd week of shipments in 2011, partially

offset by higher commodity costs, the impact of divestitures (lower income from a transition services agreement related to

the Frozen Pizza business), unfavorable volume/mix, and higher advertising and consumer spending.

31