Kraft 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

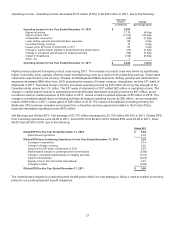

These costs are reflected in our cost of sales and selling, general and administrative expenses. These costs were funded

through intercompany transactions with Mondele¯z International and were reflected within the parent company investment

equity balance. The increase in benefit plan costs allocated to us from Mondele¯ z International in 2012 compared to 2011,

on an annualized basis, is due to an increase in the benefit plan costs recognized by Mondele¯ z International in 2012

driven by a decrease in the discount rate used.

Certain pension plans in our Canadian operations and our other postemployment benefit plans were our direct obligations

and have been recorded within our historical financial statements. We recorded amounts relating to these plans and the

remaining pension, postretirement, and other postemployment benefit plans transferred from Mondele¯z International on

October 1, 2012, based on calculations specified by U.S. GAAP. These calculations require the use of various actuarial

assumptions, such as discount rates, assumed rates of return on plan assets, compensation increases, and turnover

rates. We review our actuarial assumptions on an annual basis and make modifications to the assumptions based on

current rates and trends when appropriate. We believe that the assumptions used in recording our pension,

postretirement, and other postemployment benefit plan obligations are reasonable based on our experience and advice

from our actuaries. See Note 10, Postemployment Benefit Plans, to the consolidated financial statements for a discussion

of the assumptions used.

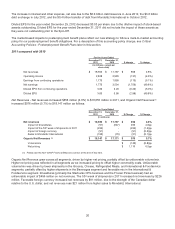

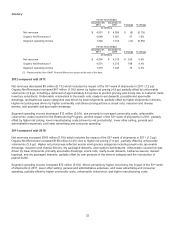

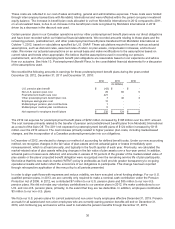

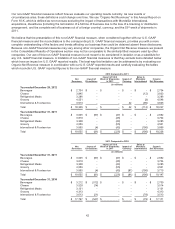

We recorded the following amounts in earnings for these postemployment benefit plans during the years ended

December 29, 2012, December 31, 2011 and December 31, 2010:

2012 2011 2010

(in millions)

U.S. pension plan benefit $ (43) $ - $ -

Non-U.S. pension plan cost 29 82 5

Postretirement health care cost 221 - -

Other postemployment benefit plan cost 7 42 3

Employee savings plan cost 12 - -

Multiemployer pension plan contributions 1 - -

Multiemployer medical plan contributions 5 - -

Net expense for employee benefit plans $ 232 $ 124 $ 8

The 2012 net expense for postemployment benefit plans of $232 million increased by $108 million over the 2011 amount.

The cost increase primarily related to the transfer of pension and postretirement benefit plans from Mondele¯z International

as a result of the Spin-Off. The 2011 net expense for postemployment benefit plans of $124 million increased by $116

million over the 2010 amount. The cost increase primarily related to higher pension plan costs, including market-based

changes, and the incorporation of a Canadian postemployment plan into our obligations.

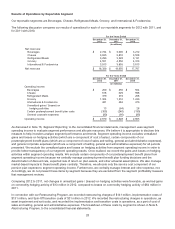

In December of 2012, we elected to change our method of accounting for defined benefit costs. Under our new accounting

method, we recognize changes in the fair value of plan assets and net actuarial gains or losses immediately upon

remeasurement, which is at least annually, and typically in the fourth quarter of each year. Previously, we calculated the

market-related value of plan assets reflecting changes in the fair value of plan assets over a four-year period. In addition,

actuarial gains or losses were deferred, and amounts in excess of 10 percent of the greater of the market-related value of

plan assets or the plans’ projected benefit obligation were recognized over the remaining service life of plan participants.

We believe that this new mark-to-market (“MTM”) policy is preferable as it will provide greater transparency to on-going

operational results and better reflect the economics of our obligations to participants. This change has been reported

through retrospective application of the new policy to all periods presented.

In order to align cash flows with expenses and reduce volatility, we have executed a level funding strategy. For our U.S.

qualified pension plans, in 2013, we are currently only required to make a nominal cash contribution under the Pension

Protection Act of 2006. In 2012, we contributed $7 million to our U.S. pension plans and $35 million to our non-U.S.

pension plans. We did not make any voluntary contributions to our pension plans in 2012. We make contributions to our

U.S. and non-U.S. pension plans, primarily, to the extent that they are tax deductible. In addition, employees contributed

$3 million to our non-U.S. plans.

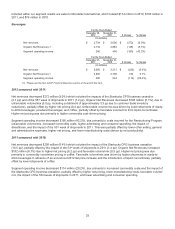

We froze our U.S. pension plans for current salaried and non-union hourly employees effective December 31, 2019. Pension

accruals for all salaried and non-union employees who are currently earning pension benefits will end on December 31,

2019, and continuing pay and service will be used to calculate the pension benefits through December 31, 2019.

36