Kraft 2012 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2012 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

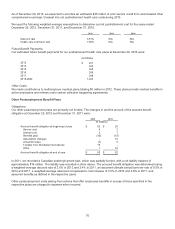

Third-Party Guarantees:

We have third-party guarantees primarily covering certain long-term obligations of our vendors. As part of those

transactions, we guarantee that third parties will make contractual payments or achieve performance measures. At

December 29, 2012, the carrying amount of our third-party guarantees on our consolidated balance sheet and the

maximum potential payment under these guarantees was $22 million. We have off-balance sheet guarantees primarily

covering third-party contractual payments related to leased properties. At December 29, 2012, the maximum potential

payments under these off-balance sheet guarantees was $42 million. Substantially all of these guarantees expire at

various times through 2027.

As of December 29, 2012, Mondele¯z International and three of its indirect wholly owned subsidiaries, including a

subsidiary that became our indirect wholly owned subsidiary as a result of the Spin-Off, are joint and several guarantors of

$1.0 billion of indebtedness issued by Cadbury Schweppes US Finance LLC and maturing on October 1, 2013. Under the

Separation and Distribution Agreement between Mondele¯z International and us, Mondele¯z International has agreed to

indemnify us in the event our subsidiary is called upon to satisfy its obligation under the guarantee. Accordingly, we have

no obligation included on our balance sheets for this guarantee.

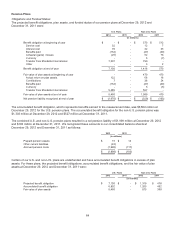

Leases:

Rental expenses were $150 million in 2012, $169 million in 2011, and $168 million in 2010. As of December 29, 2012,

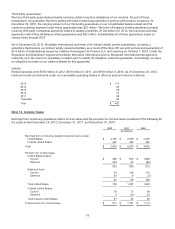

minimum rental commitments under non-cancelable operating leases in effect at year-end were (in millions):

2013 $ 115

2014 93

2015 59

2016 47

2017 38

Thereafter 90

Total $ 442

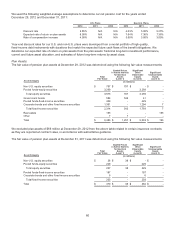

Note 13. Income Taxes

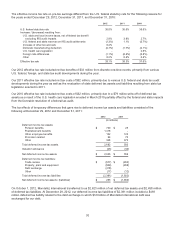

Earnings from continuing operations before income taxes and the provision for income taxes consisted of the following for

the years ended December 29, 2012, December 31, 2011, and December 31, 2010:

2012 2011 2010

(in millions)

Earnings from continuing operations before income taxes:

United States $ 2,156 $ 2,650 $ 2,706

Outside United States 297 226 296

Total $ 2,453 $ 2,876 $ 3,002

Provision for income taxes:

United States federal:

Current $ 209 $ 816 $ 1,000

Deferred 424 43 (88)

633 859 912

State and local:

Current 54 169 115

Deferred 43 9 (7)

97 178 108

Total United States 730 1,037 1,020

Outside United States:

Current 78 77 69

Deferred 3 (13) 23

Total outside United States 81 64 92

Total provision for income taxes $ 811 $ 1,101 $ 1,112

74