Kraft 2012 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2012 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

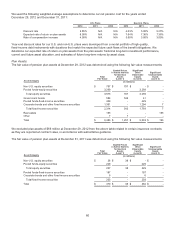

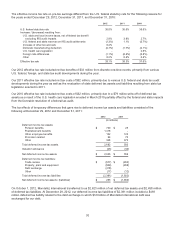

Fair value measurements:

• Level 1 - includes primarily non-U.S. equity securities and certain government bonds valued using quoted prices

in active markets.

• Level 2 - includes primarily pooled funds valued using net asset values of participation units held in common

collective trusts, as reported by the managers of the trusts and as supported by the unit prices of actual purchase

and sale transactions. Level 2 plan assets also include corporate bonds and other fixed-income securities, valued

using independent observable market inputs, such as matrix pricing, yield curves, and indices.

• Level 3 - includes investments valued using unobservable inputs that reflect the plans’ assumptions that market

participants would use in pricing the assets, based on the best information available.

• Fair value estimates for pooled funds are calculated by the investment advisor when reliable quotations or

pricing services are not readily available for certain underlying securities. The estimated value is based on

either cost, or last sale price for most of the securities valued in this fashion.

• Fair value estimates for limited partnership and private equity investments are calculated by the general

partners using the market approach to estimate the fair value of private investments. The market approach

utilizes prices and other relevant information generated by market transactions, type of security, degree of

liquidity, restrictions on the disposition, latest round of financing data, company financial statements, relevant

valuation multiples, and discounted cash flow analyses.

• Fair value estimates for real estate investments are calculated by the investment managers using the

present value of future cash flows expected to be received from the investments, based on valuation

methodologies such as appraisals, local market conditions, and current and projected operating

performance.

• Fair value estimates for investments in hedge fund-of-funds are calculated by the investment managers

using the net asset value per share of the investment as reported by the money managers of the underlying

funds.

• Fair value estimates for insurance contracts are calculated based on the future stream of benefit payments

discounted using prevailing interest rates based on the valuation date.

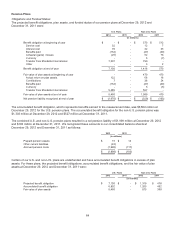

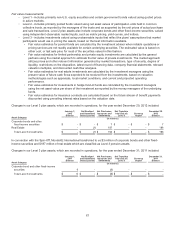

Changes in our Level 3 plan assets, which are recorded in operations, for the year ended December 29, 2012 included:

Asset Category

January 1,

2012

Balance

Net Realized

and Unrealized

Gains/(Losses)

Net Purchases,

Issuances and

Settlements

Net Transfers

Into/(Out of)

Level 3

Currency

Impact

December 29,

2012

Balance

(in millions)

Corporate bonds and other

fixed-income securities $ - $ - $ 7 $ - $ - $ 7

Real Estate - (1) 187 - - 186

Total Level 3 investments $ - $ (1) $ 194 $ - $ - $ 193

In connection with the Spin-Off, Mondele¯ z International transferred to us $3 million of corporate bonds and other fixed-

income securities and $187 million of real estate which are classified as Level 3 pension assets.

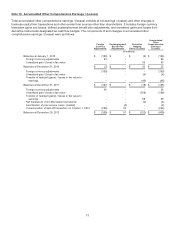

Changes in our Level 3 plan assets, which are recorded in operations, for the year ended December 31, 2011 included:

Asset Category

January 1,

2011

Balance

Net Realized

and Unrealized

Gains/(Losses)

Net Purchases,

Issuances and

Settlements

Net Transfers

Into/(Out of)

Level 3

Currency

Impact

December 31,

2011

Balance

(in millions)

Corporate bond and other fixed-income

securities 6 - (6) - - -

Total Level 3 investments $ 6$-$(6)$-$-$-

67