Kraft 2012 Annual Report Download - page 41

Download and view the complete annual report

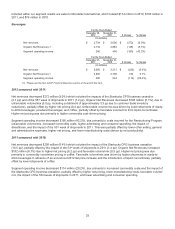

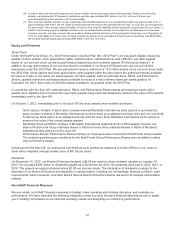

Please find page 41 of the 2012 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On May 18, 2012, we entered into a $3.0 billion five-year senior unsecured revolving credit facility that expires on May 17,

2017. All committed borrowings under the facility will bear interest at a variable annual rate based on the London Inter-

Bank Offered Rate or a defined base rate, at our election, plus an applicable margin based on the ratings of our long-term

senior unsecured indebtedness. The revolving credit agreement requires us to maintain a minimum total shareholders’

equity (excluding accumulated other comprehensive income or losses and any income or losses recognized in connection

with “mark-to-market” accounting in respect of pension and other retirement plans) of at least $2.4 billion. At December 29,

2012, our total shareholders’ equity (excluding accumulated other comprehensive income or losses and any income or

losses recognized in connection with “mark-to-market” accounting in respect of pension and other retirement plans) was

$4.0 billion. The revolving credit agreement also contains customary representations, covenants, and events of default.

We intend to use the proceeds of this facility for general corporate purposes. As of December 29, 2012, no amounts were

drawn on this credit facility.

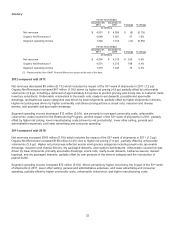

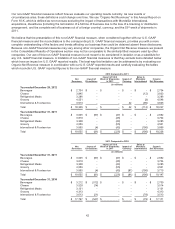

Long-Term Debt:

On June 4, 2012, we issued $6.0 billion of senior unsecured notes at a weighted-average effective rate of 3.938% and

transferred the net proceeds of $5.9 billion to Mondele¯ z International. We also recorded approximately $260 million of

deferred financing costs which will be recognized in interest expense over the life of the notes. The general terms of the

notes are:

• $1 billion of notes due June 4, 2015 at a fixed, annual interest rate of 1.625%. Interest is payable semiannually

beginning December 4, 2012.

• $1 billion of notes due June 5, 2017 at a fixed, annual interest rate of 2.250%. Interest is payable semiannually

beginning December 5, 2012.

• $2 billion of notes due June 6, 2022 at a fixed, annual interest rate of 3.500%. Interest is payable semiannually

beginning December 6, 2012.

• $2 billion of notes due June 4, 2042 at a fixed, annual interest rate of 5.000%. Interest is payable semiannually

beginning December 4, 2012.

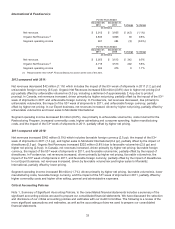

On July 18, 2012, Mondele¯ z International completed a debt exchange in which $3.6 billion of Mondele¯ z International debt

was exchanged for our debt in connection with our Spin-Off capitalization plan. No cash was generated from the

exchange. We recorded deferred tax liabilities in connection with the debt exchange and the balance was $418 million as

of December 29, 2012. The general terms of the notes issued are:

• $1,035 million of notes due August 23, 2018 at a fixed, annual interest rate of 6.125%. Interest is payable

semiannually beginning August 23, 2012. This debt was issued in exchange for $596 million of Mondele¯z

International’s 6.125% Notes due in February 2018 and $439 million of Mondele¯z International’s 6.125% Notes

due in August 2018.

• $900 million of notes due February 10, 2020 at a fixed, annual interest rate of 5.375%. Interest is payable

semiannually beginning August 10, 2012. This debt was issued in exchange for an approximately equal principal

amount of Mondele¯ z International’s 5.375% Notes due in February 2020.

• $878 million of notes due January 26, 2039 at a fixed, annual interest rate of 6.875%. Interest is payable

semiannually beginning July 26, 2012. This debt was issued in exchange for approximately $233 million of

Mondele¯z International’s 6.875% Notes due in January 2039, approximately $290 million of Mondele¯z

International’s 6.875% Notes due in February 2038, approximately $185 million of Mondele¯z International’s

7.000% Notes due in August 2037, and approximately $170 million of Mondele¯z International’s 6.500% Notes

due in November 2031.

• $787 million of notes due February 9, 2040 at a fixed, annual interest rate of 6.500%. Interest is payable

semiannually beginning August 9, 2012. This debt was issued in exchange for an approximately equal principal

amount of Mondele¯ z International’s 6.500% Notes due in 2040.

On October 1, 2012, Mondele¯ z International transferred approximately $400 million of Mondele¯z International 7.550%

senior unsecured notes maturing in June 2015 to us to complete the key elements of the debt migration plan in connection

with the Spin-Off.

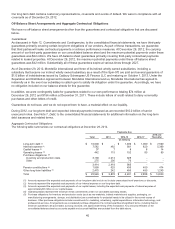

Total Debt:

Our total debt was $10.0 billion at December 29, 2012 and $35 million at December 31, 2011. The weighted-average

remaining term of our debt was 14.2 years at December 29, 2012. Prior to our debt issuance in 2012, our total debt

consisted entirely of capital lease obligations.

39