Kraft 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

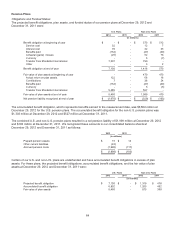

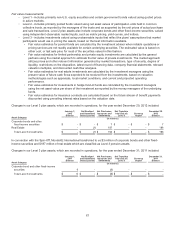

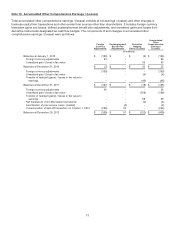

Components of Net Postemployment Costs:

Net postemployment costs consisted of the following for the years ended December 29, 2012, December 31, 2011, and

December 31, 2010:

2012 2011 2010

(in millions)

Service cost $ 4 $ 2 $ 2

Interest cost 2 1 2

Market-based changes 2 2 -

Actuarial (gains) / losses (1) 21 (1)

Other -16 -

Net postemployment costs $7$42$3

Other postemployment costs primarily relate to the recognition of the partially funded Canadian postemployment plan.

As of December 29, 2012, we do not expect to amortize any prior service cost / (credit) for the other postemployment

benefit plans from accumulated other comprehensive earnings / (losses) into net postemployment costs during 2013.

Note 11. Financial Instruments

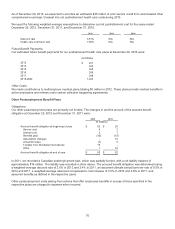

Fair Value of Derivative Instruments:

The fair values of derivative instruments recorded in the consolidated balance sheet as of December 29, 2012 and

December 31, 2011 were:

2012 2011

Asset

Derivatives

Liability

Derivatives

Asset

Derivatives

Liability

Derivatives

(in millions) (in millions)

Derivatives designated as hedging

instruments:

Commodity contracts $ 7 $ 11 $ 9 $ 2

Foreign exchange contracts 8 3 3 -

Interest rate contracts - - - 25

$15$14$12$27

Derivatives not designated as hedging

instruments:

Commodity contracts 24 34 50 68

Total fair value $ 39 $ 48 $ 62 $ 95

The fair value of our asset derivatives is recorded within other current assets and the fair value of our liability derivatives is

recorded within other current liabilities.

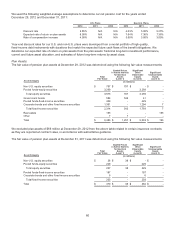

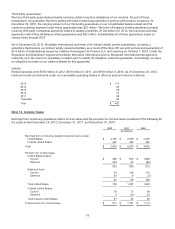

The fair values of our derivative instruments at December 29, 2012 were determined using:

Total

Fair Value of Net

Asset / (Liability)

Quoted Prices in

Active Markets

for Identical

Assets

(Level 1)

Significant

Other Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

(in millions)

Commodity contracts $ (14) $ (7) $ (7) $ -

Foreign exchange contracts 5 - 5 -

Interest rate contracts - - - -

Total derivatives $ (9) $ (7) $ (2) $ -

71