Kraft 2012 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2012 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

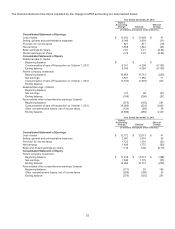

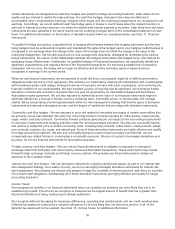

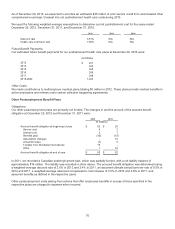

As of December 29, 2012, aggregate maturities of long-term debt were (in millions):

2013 $ 5

2014 3

2015 1,403

2016 3

2017 1,003

Thereafter 7,611

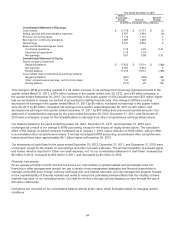

Our long term debt contains customary representations, covenants, and events of default. We were in compliance with all

covenants as of December 29, 2012.

Fair Value of Our Debt:

The aggregate fair value of our total debt was $11.5 billion as compared with the carrying value of $10.0 billion at

December 29, 2012. At December 31, 2011, our total debt only consisted of capital leases which approximated fair value.

We determined the fair value of our long-term debt using Level 1 quoted prices in active markets for the publicly traded

debt obligations.

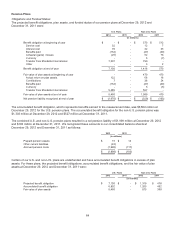

Interest and Other Expense, Net:

Interest and other expense, net consisted of:

For the Years Ended

December 29,

2012

December 31,

2011

December 31,

2010

(in millions)

Interest expense $ 238 $ 4 $ 3

Other expense / (income), net 20 3 3

Total interest and other expense, net $ 258 $ 7 $ 6

The increase in interest expense in 2012 compared to 2011 was due to the $6.0 billion debt issuance in June 2012, the

$3.6 billion debt exchange in July 2012 and the transfer of $0.4 billion of debt from Mondele¯z International in October

2012.

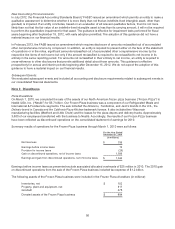

Note 8. Capital Stock

Our articles of incorporation authorize 5.0 billion shares of common stock and 500 million shares of preferred stock. On

October 1, 2012, Mondele¯ z International distributed 592 million shares of Kraft Foods Group common stock to Mondele¯z

International’s shareholders. Holders of Mondele¯ z International common stock received one share of Kraft Foods Group

common stock for every three shares of Mondele¯z International common stock held on September 19, 2012.

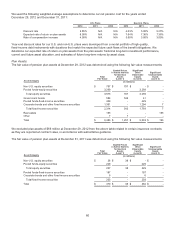

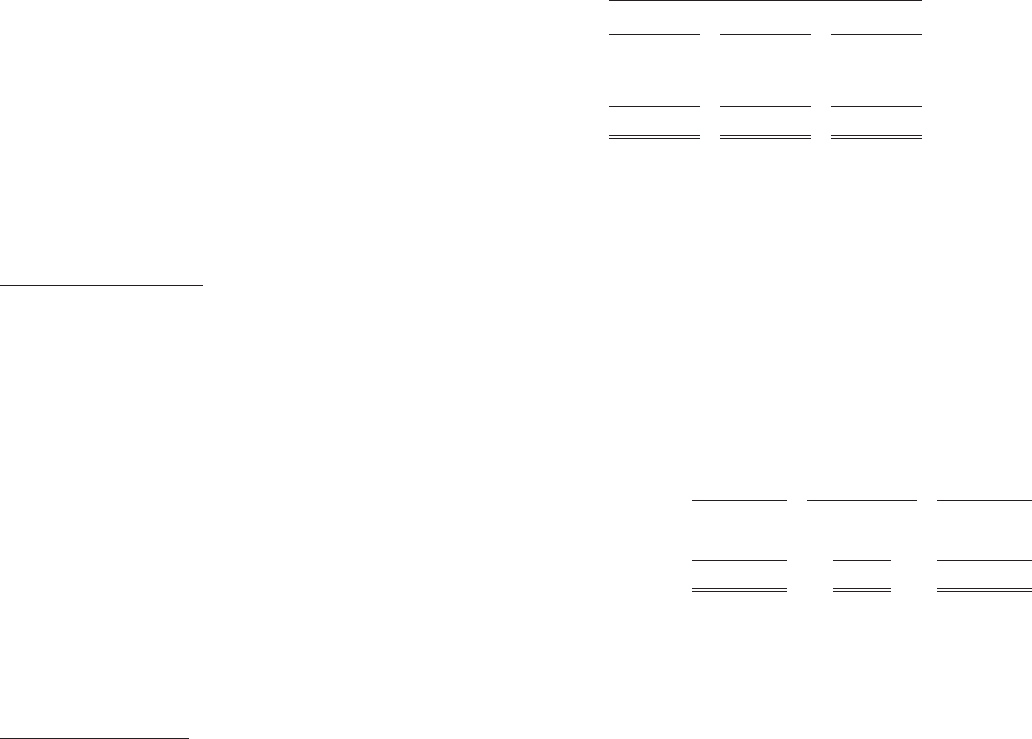

Shares of common stock issued, in treasury and outstanding were:

Shares Issued Treasury Shares

Shares

Outstanding

Consummation of spin-off transaction on October 1, 2012 592,257,298 - 592,257,298

Exercise of stock options and issuance of other stock awards 526,398 (19,988) 506,410

Balance at December 29, 2012 592,783,696 (19,988) 592,763,708

As of December 29, 2012, approximately 1.4 million outstanding shares were held in trust in connection with our restricted

stock. See Note 9, Stock Plans, for a description of these shares. There were no preferred shares issued and outstanding

at December 29, 2012.

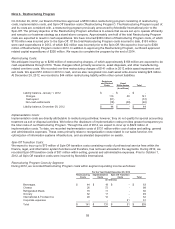

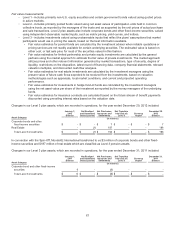

Note 9. Stock Plans

Under the Kraft Foods Group, Inc. 2012 Performance Incentive Plan (the “2012 Plan”), we may grant eligible employees

awards of stock options, stock appreciation rights, restricted stock, restricted stock units (“RSUs”), and other awards

based on our common stock, as well as performance-based long-term incentive awards (“Performance Shares”). In

addition, we may grant shares of our common stock to members of the Board of Directors who are not our full-time

60