Kraft 2012 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2012 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

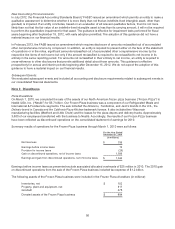

employees under the 2012 Plan. We are authorized to issue a maximum of 72.0 million shares of our common stock under

the 2012 Plan. Stock options and stock appreciation rights granted under the plan reduce the authorized shares available

for issue at a ratio of one share per award granted. All other awards, such as restricted stock, RSUs, and Performance

Shares, granted reduce the authorized shares available for issue at a ratio of three shares per award granted. At

December 29, 2012, there were 45,455,320 shares available to be granted under the 2012 Plan. All stock awards are

issued to employees from authorized common shares.

In connection with the Spin-Off, restricted stock, RSUs, and Performance Share awards and employee stock option

awards were adjusted and converted into new equity awards using a formula designed to preserve the value of the awards

immediately prior to the Spin-Off.

On October 1, 2012, immediately prior to the Spin-Off, the stock awards were modified as follows:

•Stock options: Holders of stock option awards received Mondele¯ z International stock options to purchase the

same number of shares of Mondele¯z International common stock at an adjusted exercise price and one new Kraft

Foods Group stock option at an adjusted exercise price for every three Mondele¯ z International stock options to

preserve the value of the overall awards granted.

•Restricted stock and RSUs: Holders of Mondele¯ z International restricted stock or RSU awards received one

share of Kraft Foods Group restricted shares or RSUs for every three restricted shares or RSUs of Mondele¯z

International they held prior to the Spin-Off.

•Performance Shares: Performance Shares held by our employees were converted to Kraft Foods Group awards.

The underlying performance conditions for the Kraft Foods Group Performance Shares were modified to reflect

new performance targets.

Prior to the Spin-Off, Mondele¯z International maintained several incentive plans in which our executives and employees,

and a stock compensation plan in which our non-employee directors, participated. All awards granted under the plans

were based on Mondele¯ z International’s common shares and were reflected in Mondele¯z International’s consolidated

statement of equity. The expense related to those awards was allocated to us. Stock-based compensation expense

allocated from Mondele¯z International was $39 million in 2012, $51 million in 2011, and $49 million in 2010. The expense

was allocated primarily based on headcount.

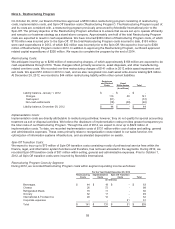

Stock Options:

Stock options are granted with an exercise price equal to the market value of the underlying stock on the grant date,

generally become exercisable in three annual installments beginning on the first anniversary of the grant date, and have a

maximum term of ten years.

We account for our employee stock options under the fair value method of accounting using a modified Black-Scholes

methodology to measure stock option expense at the date of grant. All stock option awards were granted prior to the Spin-

Off. Therefore, we estimated the value of those awards based on Mondele¯z International’s share price and assumptions.

The fair value of the stock options at the date of grant is amortized to expense over the vesting period. We recorded

compensation expense related to stock options of $5 million in the fourth quarter of 2012. The deferred tax benefit

recorded related to this compensation expense was $2 million in 2012. The unamortized compensation expense related to

our stock options was $24 million at December 29, 2012 and is expected to be recognized over a weighted-average period

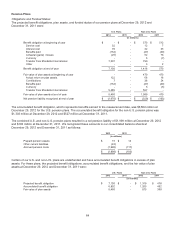

of two years. Our weighted-average Black-Scholes fair value assumptions were as follows:

Risk-Free

Interest Rate Expected Life

Expected

Volatility

Expected

Dividend Yield

Fair Value

at Grant Date

Mondele¯z International Grants

2012 1.16% 6 years 20.13% 3.08% $ 4.78

2011 2.34% 6 years 18.92% 3.72% $ 3.84

2010 2.82% 6 years 19.86% 4.14% $ 3.69

The risk-free interest rate represents the constant maturity U.S. government treasuries rate with a remaining term equal to

the expected life of the options. The expected life is the period over which our employees are expected to hold their

options. Volatility reflects historical movements in Mondele¯ z International’s stock price for a period commensurate with the

expected life of the options. Dividend yield is estimated over the expected life of the options based on Mondele¯z

International’s stated dividend policy.

61