Kraft 2012 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2012 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

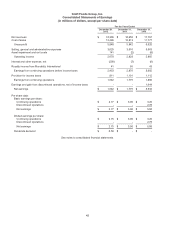

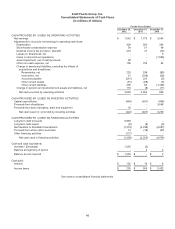

Kraft Foods Group, Inc.

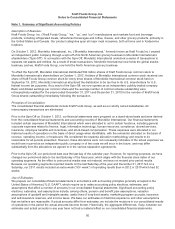

Notes to Consolidated Financial Statements

Note 1. Summary of Significant Accounting Policies

Description of Business:

Kraft Foods Group, Inc. (“Kraft Foods Group,” “we,” “us,” and “our”) manufactures and markets food and beverage

products, including refrigerated meals, refreshment beverages and coffee, cheese, and other grocery products, primarily in

the United States and Canada. Our product categories span all major meal occasions, both at home and in foodservice

locations.

On October 1, 2012, Mondele¯ z International, Inc. (“Mondele¯z International,” formerly known as Kraft Foods Inc.) created

an independent public company through a spin-off of its North American grocery business to Mondele¯z International’s

shareholders (“Spin-Off”). In connection with the Spin-Off, Mondele¯ z International undertook a series of transactions to

separate net assets and entities. As a result of these transactions, Mondele¯z International now holds the global snacks

business, and we, Kraft Foods Group, now hold the North American grocery business.

To effect the Spin-Off, Mondele¯ z International distributed 592 million shares of Kraft Foods Group common stock to

Mondele¯z International’s shareholders on October 1, 2012. Holders of Mondele¯z International common stock received one

share of Kraft Foods Group common stock for every three shares of Mondele¯ z International common stock held on

September 19, 2012. Mondele¯ z International structured the distribution to be tax free to its U.S. shareholders for U.S.

federal income tax purposes. As a result of the Spin-Off, we now operate as an independent, publicly traded company.

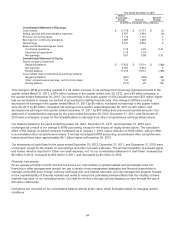

Basic and diluted earnings per common share and the average number of common shares outstanding were

retrospectively restated for the years ended December 31, 2011 and December 31, 2010 for the number of Kraft Foods

Group shares outstanding immediately following the transaction.

Principles of Consolidation:

The consolidated financial statements include Kraft Foods Group, as well as our wholly owned subsidiaries. All

intercompany transactions are eliminated.

Prior to the Spin-Off on October 1, 2012, our financial statements were prepared on a stand-alone basis and were derived

from the consolidated financial statements and accounting records of Mondele¯z International. Our financial statements

included certain expenses of Mondele¯z International which were allocated to us for certain functions, including general

corporate expenses related to finance, legal, information technology, human resources, compliance, shared services,

insurance, employee benefits and incentives, and stock-based compensation. These expenses were allocated in our

historical results of operations on the basis of direct usage when identifiable, with the remainder allocated on the basis of

revenue, operating income, or headcount. We considered the expense allocation methodology and results to be

reasonable for all periods presented. However, these allocations were not necessarily indicative of the actual expenses we

would have incurred as an independent public company or of the costs we will incur in the future, and may differ

substantially from the allocations we agreed to in the various separation agreements.

Prior to the Spin-Off, our period-end date was the last day of the calendar year. However, for reporting purposes, we have

changed our period-end date to the last Saturday of the fiscal year, which aligns with the financial close dates of our

operating segments. As the effect to prior period results was not material, we have not revised prior period results.

Because our operating segments reported results on the last Saturday of the year and December 31, 2011 fell on a

Saturday, our 2011 results included an extra week (“53rd week”) of operating results than in 2012 or 2010 which had 52

weeks.

Use of Estimates:

We prepare our consolidated financial statements in accordance with accounting principles generally accepted in the

United States of America (“U.S. GAAP”), which require us to make accounting policy elections, estimates, and

assumptions that affect a number of amounts in our consolidated financial statements. Significant accounting policy

elections, estimates, and assumptions include, among others, pension and benefit plan assumptions, valuation

assumptions of goodwill and intangible assets, useful lives of long-lived assets, marketing program accruals, insurance

and self-insurance reserves, and income taxes. We base our estimates on historical experience and other assumptions

that we believe are reasonable. If actual amounts differ from estimates, we include the revisions in our consolidated results

of operations in the period the actual amounts become known. Historically, the aggregate differences, if any, between our

estimates and actual amounts in any year have not had a material effect on our consolidated financial statements.

50