Kraft 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

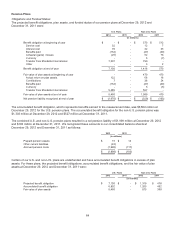

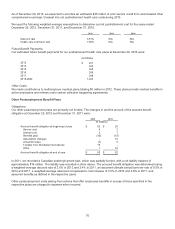

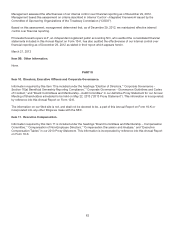

The gains / (losses), net of income taxes, reclassified from accumulated other comprehensive earnings / (losses) into

earnings were:

2012 2011 2010

(in millions)

Commodity contracts $ (49) $ 52 $ 4

Foreign exchange contracts (1) (6) (4)

Interest rate contracts (19) - -

Total $ (69) $ 46 $ -

The gains / (losses) on ineffectiveness recognized in earnings were:

2012 2011 2010

(in millions)

Commodity contracts $ (4) $ 2 $ (6)

Interest rate contracts (23) - -

Total $ (27) $ 2 $ (6)

We record the pre-tax gain or loss reclassified from accumulated other comprehensive earnings / (losses) into earnings,

and the gain or loss on ineffectiveness in:

• cost of sales for commodity contracts;

• cost of sales for foreign exchange contracts related to forecasted transactions; and

• interest and other expense, net for interest rate contracts and foreign exchange contracts related to intercompany

loans.

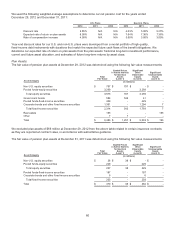

We expect to transfer unrealized losses of $13 million (net of taxes) for commodity cash flow hedges, unrealized losses of

$1 million (net of taxes) for foreign exchange contracts, and unrealized losses of $8 million (net of taxes) for interest rate

cash flow hedges to earnings during the next 12 months.

As of December 29, 2012, we had hedged forecasted transactions for the following durations:

• commodity transactions for periods not exceeding the next 15 months;

• foreign currency transactions for periods not exceeding the next 6 years; and

• interest rate transactions for periods not exceeding the next 29 years and 5 months.

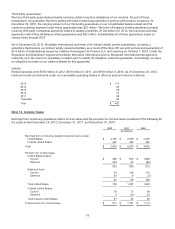

Economic Hedges:

Gains / (losses) recorded in earnings for economic hedges which are not designated as hedging instruments included:

Gain / (Loss) Recognized in Earnings

Location of

Gain / (Loss)

Recognized

in Earnings2012 2011 2010

(in millions)

Commodity contracts 36 31 36 Cost of sales

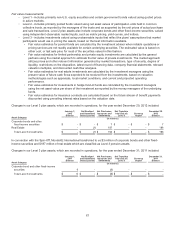

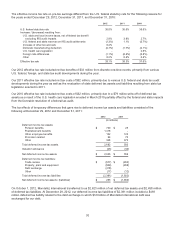

Note 12. Commitments and Contingencies

Legal Proceedings:

We are routinely involved in legal proceedings, claims, and governmental inspections or investigations (“Legal Matters”)

arising in the ordinary course of our business.

On March 1, 2011, the Starbucks Coffee Company (“Starbucks”) took control of the Starbucks packaged coffee business

(“Starbucks CPG business”) in grocery stores and other channels. Starbucks did so without our authorization and in what

we contend is a violation and breach of our license and supply agreement with Starbucks related to the Starbucks CPG

business. The dispute is in arbitration in Chicago, Illinois. While we remain the named party in the proceeding, under the

Separation and Distribution Agreement between Mondele¯z International and us, we will direct any recovery we are

awarded in the arbitration proceeding to Mondele¯z International. Mondele¯ z International will reimburse us for any costs

and expenses we incur in connection with the arbitration.

While we cannot predict with certainty the results of our dispute with Starbucks or any other Legal Matters in which we are

currently involved, we do not expect that the ultimate costs to resolve any of these Legal Matters will have a material

adverse effect on our financial results.

73