Kraft 2012 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2012 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our long term debt contains customary representations, covenants and events of default. We were in compliance with all

covenants as of December 29, 2012.

Off-Balance Sheet Arrangements and Aggregate Contractual Obligations

We have no off-balance sheet arrangements other than the guarantees and contractual obligations that are discussed

below.

Guarantees:

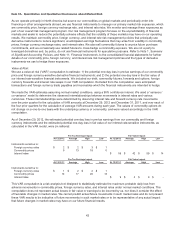

As discussed in Note 12, Commitments and Contingencies, to the consolidated financial statements, we have third-party

guarantees primarily covering certain long-term obligations of our vendors. As part of those transactions, we guarantee

that third parties will make contractual payments or achieve performance measures. At December 29, 2012, the carrying

amount of our third-party guarantees on our consolidated balance sheet and the maximum potential payments under these

guarantees was $22 million. We have off-balance sheet guarantees primarily covering third-party contractual payments

related to leased properties. At December 29, 2012, the maximum potential payments under these off-balance sheet

guarantees was $42 million. Substantially all of these guarantees expire at various times through 2027.

As of December 29, 2012, Mondele¯z International and three of its indirect wholly owned subsidiaries, including a

subsidiary that became our indirect wholly owned subsidiary as a result of the Spin-Off, are joint and several guarantors of

$1.0 billion of indebtedness issued by Cadbury Schweppes US Finance LLC and maturing on October 1, 2013. Under the

Separation and Distribution Agreement between Mondele¯z International and us, Mondele¯z International has agreed to

indemnify us in the event our subsidiary is called upon to satisfy its obligation under the guarantee. Accordingly, we have

no obligation included on our balance sheets for this guarantee.

In addition, we were contingently liable for guarantees related to our own performance totaling $74 million at

December 29, 2012 and $154 million at December 31, 2011. These include letters of credit related to dairy commodity

purchases and other letters of credit.

Guarantees do not have, and we do not expect them to have, a material effect on our liquidity.

During 2012, our long-term debt and expected interest payments increased as we recorded $10.0 billion of senior

unsecured notes. See Note 7, Debt, to the consolidated financial statements for additional information on the long-term

debt issuances and related terms.

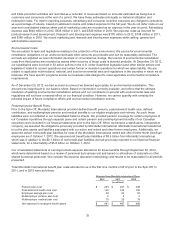

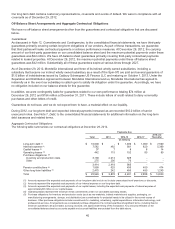

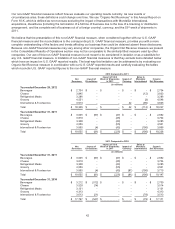

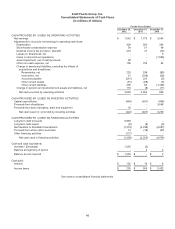

Aggregate Contractual Obligations:

The following table summarizes our contractual obligations at December 29, 2012.

Payments Due

Total 2013 2014-15 2016-17

2018 and

Thereafter

(in millions)

Long-term debt (1) $ 10,000 $ - $ 1,400 $ 1,000 $ 7,600

Interest expense (2) 7,582 462 901 820 5,399

Capital leases (3) 37 7 8 8 14

Operating leases (4) 442 115 152 85 90

Purchase obligations: (5)

Inventory and production costs 3,139 2,214 925 - -

Other 275 205 70 - -

3,414 2,419 995 - -

Pension contributions (6) 1,999 625 450 450 474

Other long-term liabilities (7) 2,475 242 495 495 1,243

Total $ 25,949 $ 3,870 $ 4,401 $ 2,858 $ 14,820

(1) Amounts represent the expected cash payments of our long-term debt and do not include unamortized bond premiums or discounts.

(2) Amounts represent the expected cash payments of our interest expense on our long-term debt.

(3) Amounts represent the expected cash payments of our capital leases, including the expected cash payments of interest expense of

approximately $9 million on our capital leases.

(4) Operating leases represent the minimum rental commitments under non-cancelable operating leases.

(5) Purchase obligations for inventory and production costs (such as raw materials, indirect materials and supplies, packaging, co-

manufacturing arrangements, storage, and distribution) are commitments for projected needs to be utilized in the normal course of

business. Other purchase obligations include commitments for marketing, advertising, capital expenditures, information technology, and

professional services. Arrangements are considered purchase obligations if a contract specifies all significant terms, including fixed or

minimum quantities to be purchased, a pricing structure, and approximate timing of the transaction. Any amounts reflected on the

consolidated balance sheet as accounts payable and accrued liabilities are excluded from the table above.

40