Kraft 2012 Annual Report Download - page 43

Download and view the complete annual report

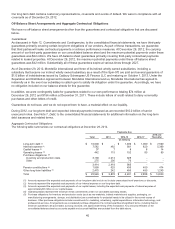

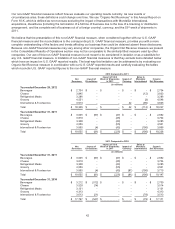

Please find page 43 of the 2012 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(6) In order to align cash flows with expenses and reduce volatility, we have executed a level funding strategy. Based our level funding

strategy, we estimate that 2013 pension contributions would be approximately $625 million to our U.S. and non-U.S plans and

approximately $225 million annually in 2014 and thereafter.

(7) Other long-term liabilities primarily consist of estimated future benefit payments for our postretirement health care plans through 2022 of

approximately $2,466 million. We are unable to reliably estimate the timing of the payments beyond 2022; as such, they are excluded from

the above table. There are also another $9 million of various other long-term liabilities that are expected to be paid over the next 5 years. In

addition, the following long-term liabilities included on the consolidated balance sheet are excluded from the table above: income taxes,

insurance accruals, and other accruals. We are unable to reliably estimate the timing of the payments for these items. As of December 29,

2012, our total liability for income taxes, including uncertain tax positions and associated accrued interest and penalties, was $438 million.

We currently estimate paying approximately $180 million in the next 12 months.

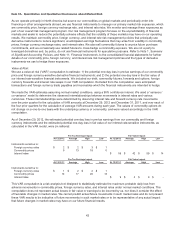

Equity and Dividends

Stock Plans:

Under the Kraft Foods Group, Inc. 2012 Performance Incentive Plan (the “2012 Plan”), we may grant eligible employees

awards of stock options, stock appreciation rights, restricted stock, restricted stock units (“RSUs”), and other awards

based on our common stock, as well as performance-based long-term incentive awards (“Performance Shares”). In

addition, we may grant shares of our common stock to members of our Board of Directors who are not our full-time

employees under the 2012 Plan. We are authorized to issue a maximum of 72.0 million shares of our common stock under

the 2012 Plan. Stock options and stock appreciation rights granted under the plan reduce the authorized shares available

for issue at a ratio of one share per award granted. All other awards, such as restricted stock, RSUs, and Performance

Shares, granted reduce the authorized shares available for issue at a ratio of three shares per award granted. At

December 29, 2012, there were 45,455,320 shares available to be granted under the 2012 Plan.

In connection with the Spin-Off, restricted stock, RSUs, and Performance Share awards and employee stock option

awards were adjusted and converted into new equity awards using a formula designed to preserve the value of the awards

immediately prior to the Spin-Off.

On October 1, 2012, immediately prior to the Spin-Off, the stock awards were modified as follows:

•Stock options: Holders of stock option awards received Mondele¯ z International stock options to purchase the

same number of shares of Mondele¯z International common stock at an adjusted exercise price and one new Kraft

Foods Group stock option at an adjusted exercise price for every three Mondele¯ z International stock options to

preserve the value of the overall awards granted.

•Restricted Stock and RSUs: Holders of Mondele¯z International restricted stock or RSU awards received one

share of Kraft Foods Group restricted shares or RSUs for every three restricted shares or RSUs of Mondele¯z

International they held prior to the Spin-Off.

•Performance Shares: Performance Shares held by our employees were converted to Kraft Foods Group awards.

The underlying performance conditions for the Kraft Foods Group Performance Shares were modified to reflect

new performance targets.

Subsequent to the Spin-Off, our employees and directors were granted an additional 0.4 million RSUs of our common

stock with a weighted average market value of $41.95 per share.

Dividends:

On December 10, 2012, our Board of Directors declared a $0.50 per common share dividend, payable on January 14,

2013. We recorded $296 million of dividends payable as of December 29, 2012. No dividends were paid in 2012, 2011, or

2010. The present annualized dividend rate is $2.00 per common share. The declaration of dividends is subject to the

discretion of our Board of Directors and depends on various factors, including our net earnings, financial condition, cash

requirements, future prospects, and other factors that our Board of Directors deems relevant to its analysis and decision

making.

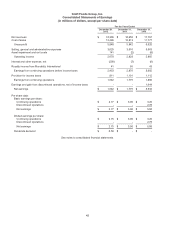

Non-GAAP Financial Measures

We use certain non-GAAP financial measures to budget, make operating and strategic decisions, and evaluate our

performance. We have disclosed the following measures so that you have the same financial data that we use to assist

you in making comparisons to our historical operating results and analyzing our underlying performance.

41