Kraft 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

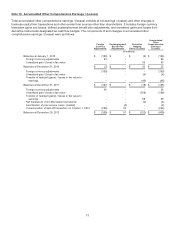

As of December 29, 2012, we expected to amortize an estimated $26 million of prior service credit from accumulated other

comprehensive earnings / (losses) into net postretirement health care costs during 2013.

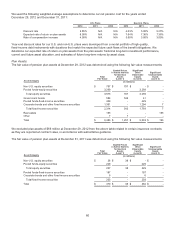

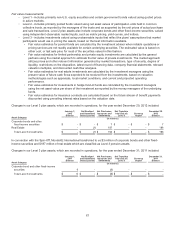

We used the following weighted-average assumptions to determine our net postretirement cost for the years ended

December 29, 2012, December 31, 2011, and December 31, 2010:

2012 2011 2010

Discount rate 3.61% N/A N/A

Health care cost trend rate 7.06% N/A N/A

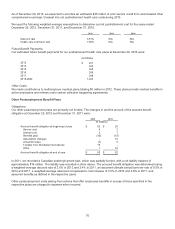

Future Benefit Payments:

Our estimated future benefit payments for our postretirement health care plans at December 29, 2012 were:

(in millions)

2013 $ 241

2014 243

2015 245

2016 246

2017 248

2018-2022 1,243

Other Costs:

We made contributions to multiemployer medical plans totaling $5 million in 2012. These plans provide medical benefits to

active employees and retirees under certain collective bargaining agreements.

Other Postemployment Benefit Plans

Obligations:

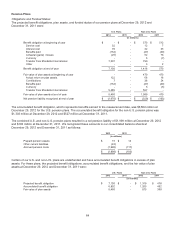

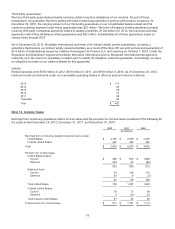

Our other postemployment plans are primarily not funded. The changes in and the amount of the accrued benefit

obligation at December 29, 2012 and December 31, 2011 were:

2012 2011

(in millions)

Accrued benefit obligation at beginning of year $ 52 $ 26

Service cost 4 2

Interest cost 2 1

Benefits paid (10) (15)

Assumption changes - 16

Actuarial losses (1) 6

Transfer from Mondele¯ z International 15 -

Other 1 16

Accrued benefit obligation at end of year $ 63 $ 52

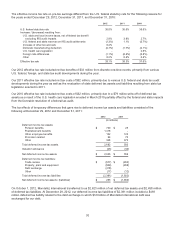

In 2011, we recorded a Canadian postemployment plan, which was partially funded, with a net liability balance of

approximately $16 million. The liability was recorded in other above. The accrued benefit obligation was determined using

a weighted-average discount rate of 2.6% in 2012 and 3.4% in 2011, an assumed ultimate annual turnover rate of 0.5% in

2012 and 2011, a weighted-average assumed compensation cost increase of 3.5% in 2012 and 4.0% in 2011, and

assumed benefits as defined in the respective plans.

Other postemployment costs arising from actions that offer employees benefits in excess of those specified in the

respective plans are charged to expense when incurred.

70