Kraft 2012 Annual Report Download - page 25

Download and view the complete annual report

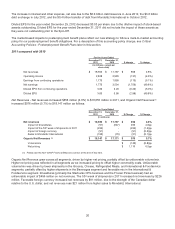

Please find page 25 of the 2012 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We assumed net benefit plan liabilities of $5.5 billion from Mondele¯z International, which was in addition to the $0.1 billion

of net benefit plan liabilities we had previously reported in our historical financial statements, for a total liability of $5.6

billion on October 1, 2012.

For more information, see Critical Accounting Policies - Postemployment Benefit Plans later in this section.

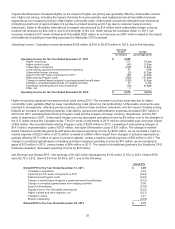

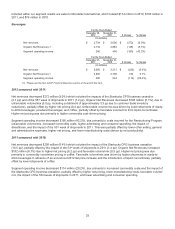

Restructuring Program

On October 29, 2012, our Board of Directors approved a $650 million restructuring program consisting of restructuring

costs, implementation costs, and Spin-Off transition costs (“Restructuring Program”). The Restructuring Program is part of,

and its costs are consistent with, a restructuring program previously announced by Mondele¯ z International prior to the

Spin-Off. The primary objective of the Restructuring Program activities is to ensure that we are set up to operate efficiently

and execute our business strategy as a stand-alone company. Approximately one-half of the total Restructuring Program

costs are expected to result in cash expenditures. We have incurred $303 million of Restructuring Program costs, of which

$170 million was incurred prior to the Spin-Off. Of the total Restructuring Program costs incurred to date, $153 million

were cash expenditures in 2012, of which $32 million was incurred prior to the Spin-Off. We expect to incur up to $300

million of Restructuring Program costs in 2013. In addition to approving the Restructuring Program, our Board approved

related capital expenditures of approximately $200 million. We expect to complete the program by the end of 2014. See

Note 6, Restructuring Program, for additional information.

Starbucks CPG Business

On March 1, 2011, Starbucks took control of the Starbucks CPG business in grocery stores and other channels. Starbucks

did so without our authorization and in what we contend is a violation and breach of our license and supply agreement with

Starbucks related to the Starbucks CPG business. The dispute is in arbitration in Chicago, Illinois. While we remain the

named party in the proceeding, under the Separation and Distribution Agreement between Mondele¯ z International and us,

we will direct any recovery we are awarded in the arbitration proceeding to Mondele¯ z International. Mondele¯z International

will reimburse us for any costs and expenses we incur in connection with the arbitration.

Divestitures

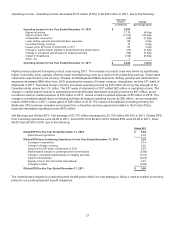

Pizza Divestiture:

On March 1, 2010, we completed the sale of the assets of our North American frozen pizza business (“Frozen Pizza”) to

Nestlé USA, Inc. (“Nestlé”) for $3.7 billion. Our Frozen Pizza business was a component of our Refrigerated Meals and

International & Foodservice segments. The sale included the DiGiorno,Tombstone, and Jack’s brands in the U.S., the

Delissio brand in Canada and the California Pizza Kitchen trademark license. It also included two Wisconsin

manufacturing facilities (Medford and Little Chute) and the leases for the pizza depots and delivery trucks. Approximately

3,600 of our employees transferred with the business to Nestlé. Accordingly, the results of our Frozen Pizza business

have been reflected as discontinued operations on the consolidated statement of earnings for 2010. As a result of the

divestiture, we recorded a gain on discontinued operations of $1,596 million, net of taxes, in 2010.

Pursuant to our transition services agreement with Nestlé, we agreed to provide certain sales, co-manufacturing,

distribution, information technology, accounting, and finance services to Nestlé for up to two years. As of December 31,

2011, these service agreements were substantially complete.

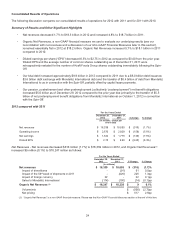

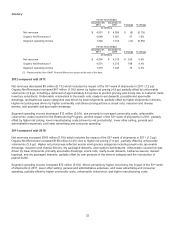

Provision for Income Taxes

Our effective tax rate was 33.1% in 2012, 38.3% in 2011, and 37.0% in 2010. Our 2012 effective tax rate included net tax

benefits of $33 million from discrete one-time events, primarily from various U.S. federal, foreign, and state tax audit

developments during the year.

Our 2011 effective tax rate included net tax costs of $52 million, primarily from various U.S. federal and U.S. state tax audit

developments during the year as well as the revaluation of state deferred tax assets and liabilities resulting from state tax

legislation enacted in 2011.

Our 2010 effective tax rate included net tax costs of $32 million, primarily due to a $79 million write-off of deferred tax

assets as a result of the U.S. health care legislation enacted in March 2010, partially offset by the federal and state

impacts from the favorable resolution of a federal tax audit.

23