Kraft 2012 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2012 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

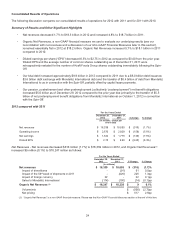

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion should be read in conjunction with the other sections of this Annual Report on Form 10-K,

including the consolidated financial statements and related notes contained in Item 8.

Description of the Company

We operate one of the largest consumer packaged food and beverage companies in North America. We manufacture and

market refrigerated meals, refreshment beverages and coffee, cheese, and other grocery products, primarily in the United

States and Canada. Our product categories span all major meal occasions, both at home and in foodservice locations.

Spin-Off Transaction

Prior to October 1, 2012, we were a wholly owned subsidiary of Mondele¯z International. In connection with the Spin-Off,

Mondele¯z International undertook a series of transactions to separate net assets and entities. As a result of these

transactions, Mondele¯ z International now holds the global snacks business, and we, Kraft Foods Group, now hold the

North American grocery business.

To effect the Spin-Off, Mondele¯ z International distributed 592 million shares of Kraft Foods Group common stock to

Mondele¯z International’s shareholders on October 1, 2012. Holders of Mondele¯z International common stock received one

share of Kraft Foods Group common stock for every three shares of Mondele¯ z International common stock held on

September 19, 2012. Mondele¯ z International structured the Distribution to be tax free to its U.S. shareholders for U.S.

federal income tax purposes. As a result of the Spin-Off, we now operate as an independent, publicly traded company.

Discussion and Analysis

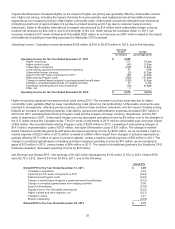

Items Affecting Comparability of Financial Results

Principles of Consolidation

Prior to the Spin-Off on October 1, 2012, our financial statements were prepared on a stand-alone basis and were derived

from the consolidated financial statements and accounting records of Mondele¯z International. Our financial statements

included certain expenses of Mondele¯z International which were allocated to us for certain functions. These allocations

were not necessarily indicative of the actual expenses we would have incurred as an independent public company or of

the costs we will incur in the future, and may differ substantially from the allocations we agreed to in the various separation

agreements.

In December 2012, we changed our fiscal year end from December 31 to the last Saturday in December. Our 2012 fiscal

year ended on December 29, 2012. For 2011 and 2010, our fiscal years ended on December 31 of that year.

See Critical Accounting Policies - Principles of Consolidation later in this section for further information about our

allocations of expenses and change in fiscal year.

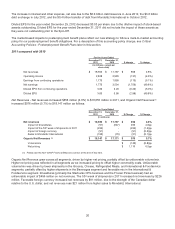

Debt

On May 18, 2012, we entered into a $3.0 billion five-year senior unsecured revolving credit facility in connection with the

Spin-Off. The agreement expires on May 17, 2017. On June 4, 2012, we issued $6.0 billion of senior unsecured notes with

a weighted average interest rate of 3.938% and transferred the net proceeds of $5.9 billion to Mondele¯ z International. In

addition, Mondele¯ z International completed a debt exchange in which $3.6 billion of Mondele¯z International debt was

exchanged for our debt as part of our Spin-Off-related capitalization plan on July 18, 2012. No cash was generated from

the exchange. On October 1, 2012, Mondele¯z International also transferred approximately $0.4 billion of Mondele¯z

International 7.550% senior unsecured notes to us to complete the key elements of the debt migration plan in connection

with the Spin-Off. At December 31, 2011, our total debt of $35 million consisted of capital leases.

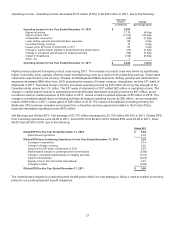

Postemployment Benefit Plans

On October 1, 2012, Mondele¯ z International transferred to us certain postemployment benefit plan assets and liabilities

associated with our active and retired and other former employees. Additionally, we assumed certain net benefit plan

liabilities for most of the Mondele¯z International retired and other former North American employees as of October 1, 2012.

22