Kraft 2012 Annual Report Download - page 57

Download and view the complete annual report

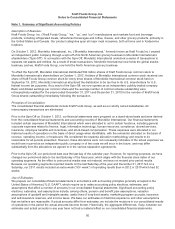

Please find page 57 of the 2012 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Certain derivatives are designated as cash flow hedges and qualify for hedge accounting treatment, while others do not

qualify and are marked to market through earnings. For cash flow hedges, changes in fair value are deferred in

accumulated other comprehensive earnings / (losses) within equity until the underlying hedged items are recognized in net

earnings. Accordingly, we record deferred cash flow hedge gains or losses in cost of sales when the related inventory is

sold and in interest and other expense, net, when the related debt interest expense is recorded. Cash flows from derivative

instruments are also classified in the same manner as the underlying hedged items in the consolidated statement of cash

flows. For additional information on the location of derivative activity within our operating results, see Note 11, Financial

Instruments.

To qualify for hedge accounting, a specified level of hedging effectiveness between the hedging instrument and the item

being hedged must be achieved at inception and maintained throughout the hedged period. Any hedging ineffectiveness is

recognized in net earnings when the change in the value of the hedge does not offset the change in the value of the

underlying hedged item. We formally document our risk management objectives, strategies for undertaking the various

hedge transactions, the nature of and relationships between the hedging instruments and hedged items, and method for

assessing hedge effectiveness. Additionally, for qualified hedges of forecasted transactions, we specifically identify the

significant characteristics and expected terms of the forecasted transactions. If it becomes probable that a forecasted

transaction will not occur, the hedge will no longer be effective and all of the derivative gains or losses would be

recognized in earnings in the current period.

When we use financial instruments, we are exposed to credit risk that a counterparty might fail to fulfill its performance

obligations under the terms of our agreement. We minimize our credit risk by entering into transactions with counterparties

with investment grade credit ratings, limiting the amount of exposure we have with each counterparty, and monitoring the

financial condition of our counterparties. We also maintain a policy of requiring that all significant, non-exchange traded

derivative contracts with a duration of greater than one year be governed by an International Swaps and Derivatives

Association master agreement. We are also exposed to market risk as the value of our financial instruments might be

adversely affected by a change in foreign currency exchange rates, commodity prices, or interest rates. We manage

market risk by incorporating monitoring parameters within our risk management strategy that limit the types of derivative

instruments and derivative strategies we use, and the degree of market risk that we hedge with derivative instruments.

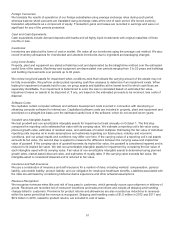

Commodity cash flow hedges - We are exposed to price risk related to forecasted purchases of certain commodities that

we primarily use as raw materials. We enter into commodity forward contracts primarily for coffee beans, meat products,

sugar, wheat, and dairy products. Commodity forward contracts generally are not subject to the accounting requirements

for derivative instruments and hedging activities under the normal purchases exception. We also use commodity futures

and options to hedge the price of certain commodity costs, including dairy products, coffee beans, meat products, wheat,

corn products, soybean oils, sugar, and natural gas. Some of these derivative instruments are highly effective and qualify

for hedge accounting treatment. We also sell commodity futures to unprice future purchase commitments, and we

occasionally use related futures to cross-hedge a commodity exposure. We are not a party to leveraged derivatives and,

by policy, do not use financial instruments for speculative purposes.

Foreign currency cash flow hedges - We use various financial instruments to mitigate our exposure to changes in

exchange rates from third-party and intercompany actual and forecasted transactions. These instruments may include

forward foreign exchange contracts and foreign currency options. We primarily use these instruments to hedge our

exposure to the Canadian dollar.

Interest rate cash flow hedges - We use derivative instruments, including interest rate swaps, as part of our interest rate

risk management strategy. As a matter of policy, we do not use highly leveraged derivative instruments for interest rate

risk management. We primarily use interest rate swaps to hedge the variability of interest payment cash flows on a portion

of our future debt obligations. Substantially all of these derivative instruments are highly effective and qualify for hedge

accounting treatment.

Income Taxes:

We recognize tax benefits in our financial statements when our uncertain tax positions are more likely than not to be

sustained upon audit. The amount we recognize is measured as the largest amount of benefit that has a greater than

50 percent likelihood of being realized upon ultimate settlement.

We recognize deferred tax assets for temporary differences, operating loss carryforwards, and tax credit carryforwards.

Deferred tax assets are reduced by a valuation allowance if it is more likely than not that some portion, or all, of the

deferred tax assets will not be realized. See Note 13, Income Taxes, for additional information.

55