Kraft 2012 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2012 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

New Accounting Pronouncements:

In July 2012, the Financial Accounting Standards Board (“FASB”) issued an amendment which permits an entity to make a

qualitative assessment to determine whether it is more likely than not that an indefinite-lived intangible asset, other than

goodwill, is impaired. If an entity concludes, based on an evaluation of all relevant qualitative factors, that it is not more

likely than not that the fair value of an indefinite-lived intangible asset is less than its carrying amount, it will not be required

to perform the quantitative impairment for that asset. The guidance is effective for impairment tests performed for fiscal

years beginning after September 15, 2012, with early adoption permitted. The adoption of this guidance did not have a

material impact on our financial results.

In February 2013, the FASB issued an amendment which requires disclosure of amounts reclassified out of accumulated

other comprehensive income by component. In addition, an entity is required to present either on the face of the statement

of operations or in the notes, significant amounts reclassified out of accumulated other comprehensive income by the

respective line items of net income but only if the amount reclassified is required to be reclassified to net income in its

entirety in the same reporting period. For amounts not reclassified in their entirety to net income, an entity is required to

cross-reference to other disclosures that provide additional detail about those amounts. This guidance is effective

prospectively for annual and interim periods beginning after December 15, 2012. We do not expect the adoption of this

guidance to have a material impact on our financial results.

Subsequent Events:

We evaluated subsequent events and included all accounting and disclosure requirements related to subsequent events in

our consolidated financial statements.

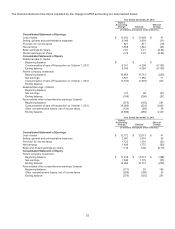

Note 2. Divestitures

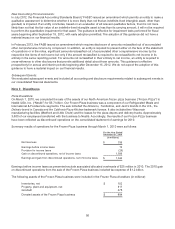

Pizza Divestiture:

On March 1, 2010, we completed the sale of the assets of our North American frozen pizza business (“Frozen Pizza”) to

Nestlé USA, Inc. (“Nestlé”) for $3.7 billion. Our Frozen Pizza business was a component of our Refrigerated Meals and

International & Foodservice segments. The sale included the DiGiorno,Tombstone, and Jack’s brands in the U.S., the

Delissio brand in Canada and the California Pizza Kitchen trademark license. It also included two Wisconsin

manufacturing facilities (Medford and Little Chute) and the leases for the pizza depots and delivery trucks. Approximately

3,600 of our employees transferred with the business to Nestlé. Accordingly, the results of our Frozen Pizza business

have been reflected as discontinued operations on the consolidated statement of earnings for 2010.

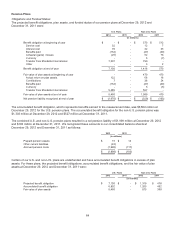

Summary results of operations for the Frozen Pizza business through March 1, 2010 were as follows:

For the Year Ended

December 31, 2010

(in millions)

Net revenues $ 335

Earnings before income taxes 73

Provision for income taxes (25)

Gain on discontinued operations, net of income taxes 1,596

Earnings and gain from discontinued operations, net of income taxes $ 1,644

Earnings before income taxes as presented exclude associated allocated overheads of $25 million in 2010. The 2010 gain

on discontinued operations from the sale of the Frozen Pizza business included tax expense of $1.2 billion.

The following assets of the Frozen Pizza business were included in the Frozen Pizza divestiture (in millions):

Inventories, net $ 102

Property, plant and equipment, net 317

Goodwill 475

Divested assets of the Frozen Pizza business $ 894

56