Kraft 2012 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2012 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

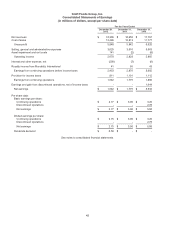

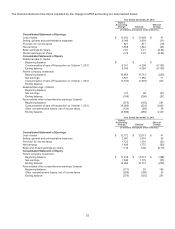

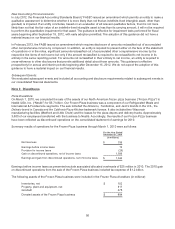

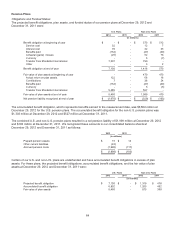

Year Ended December 31, 2010

Before

Accounting

Change Revised

Effect of

Change

(in millions, except per share amounts)

Consolidated Statement of Earnings

Cost of sales $ 11,778 $ 11,777 $ (1)

Selling, general and administrative expenses 3,067 3,063 (4)

Provision for income taxes 1,110 1,112 2

Earnings from continuing operations 1,887 1,890 3

Net earnings 3,531 3,534 3

Basic and diluted earnings per share:

Continuing operations 3.19 3.20 0.01

Discontinued operations 2.78 2.78 -

Net earnings 5.97 5.98 0.01

Consolidated Statement of Equity

Parent company investment

Beginning balance $ 17,813 $ 17,614 $ (199)

Net earnings 3,531 3,534 3

Ending balance 17,210 17,012 (198)

Accumulated other comprehensive earnings/ (losses)

Beginning balance (301) (103) 198

Other comprehensive earnings, net of income taxes 131 128 (3)

Ending balance (171) 25 196

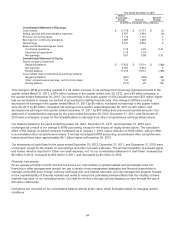

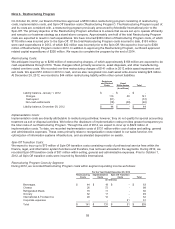

This change to MTM accounting resulted in a $5 million increase in net earnings from previously reported amounts in the

quarter ended March 31, 2012, a $10 million increase in the quarter ended June 30, 2012, and a $4 million decrease in

the quarter ended September 30, 2012. Our net earnings in the fourth quarter of 2012 would have been $37 million higher

had we not elected to change our method of accounting for defined benefit costs. The change to MTM accounting

decreased net earnings in the quarter ended March 31, 2011 by $5 million, increased net earnings in the quarter ended

June 30, 2011 by $9 million, increased net earnings in the quarter ended September 30, 2011 by $15 million, and

decreased net earnings in the quarter ended December 31, 2011 by $74 million from previously reported amounts. Our

statement of comprehensive earnings for the years ended December 29, 2012, December 31, 2011, and December 31,

2010 were unchanged, except for the reclassifications to earnings from other comprehensive earnings shown above.

Our balance sheets for the years ended December 29, 2012, December 31, 2011, and December 31, 2010 were

unchanged as a result of our change to MTM accounting, except for the impact on equity shown above. The cumulative

effect of the change on parent company investment as of January 1, 2010, was a reduction of $199 million, with an offset

to accumulated other comprehensive losses. If we had not adopted MTM accounting, accumulated other comprehensive

losses would have been approximately $4.1 billion higher at December 29, 2012.

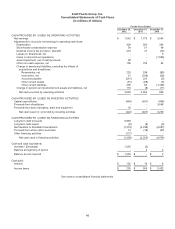

Our statements of cash flows for the years ended December 29, 2012, December 31, 2011, and December 31, 2010 were

unchanged, except for the impact on net earnings and other non-cash expenses. The annual recognition of actuarial gains

and losses, which is reported in “Other non-cash expense, net” on our consolidated statement of cash flows, increased by

$4 million in 2012, increased by $92 million in 2011, and decreased by $3 million in 2010.

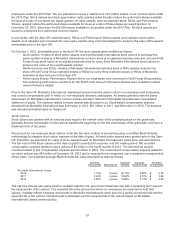

Financial Instruments:

As we operate primarily in North America but source our commodities on global markets and periodically enter into

financing or other arrangements abroad, we use a variety of risk management strategies and financial instruments to

manage commodity price, foreign currency exchange rate, and interest rate risks. Our risk management program focuses

on the unpredictability of financial markets and seeks to reduce the potentially adverse effects that the volatility of these

markets may have on our operating results. One way we do this is through actively hedging our risks through the use of

derivative instruments.

Derivatives are recorded on our consolidated balance sheets at fair value, which fluctuates based on changing market

conditions.

54