Kraft 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

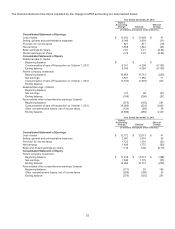

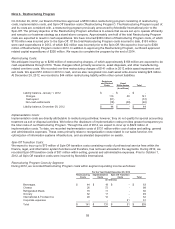

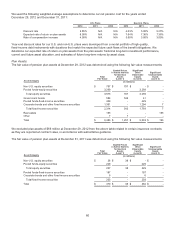

A summary of stock option activity related to our shares for both our and Mondele¯ z International employees for the year

ended December 29, 2012 is presented below. All awards granted have been adjusted to reflect the conversion as of the

Spin-Off. With respect to the Mondele¯z International stock options granted prior to the Spin-Off, the converted options

retained the vesting schedule and expiration date of the original stock options. Stock option activity for the year ended

December 29, 2012 was:

Shares

Subject to

Option

Weighted-

Average

Exercise Price

Average

Remaining

Contractual

Term

Aggregate

Intrinsic

Value

Balance at January 1, 2012 - $ -

Options converted on October 1, 2012 in

connection with the Spin-Off 17,834,682 32.36

Options granted - -

Options exercised (496,440) 28.61

Options cancelled (152,461) 33.98

Balance at December 29, 2012 17,185,781 32.45 7 years $206 million

Exercisable at December 29, 2012 8,088,080 29.00 6 years $125 million

The total intrinsic value of options exercised subsequent to the Spin-Off was $8 million in 2012. Cash received from

options exercised was $15 million in 2012. The actual tax benefit realized for the tax deductions from the option exercises

totaled $1 million in 2012.

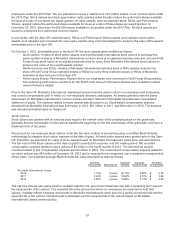

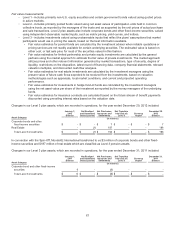

Restricted Stock, RSUs, and Performance Shares:

We may grant shares of restricted stock or RSUs to eligible employees and directors, giving them, in most instances, all of

the rights of shareholders, except that they may not sell, assign, pledge, or otherwise encumber the shares. Shares of

restricted stock and RSUs are subject to forfeiture if certain employment conditions are not met. Restricted stock and

RSUs generally vest on the third anniversary of the grant date.

Shares granted in connection with our performance share plan, and in connection with Mondele¯z International’s long-term

incentive plan prior to the Spin-Off, vest based on varying performance, market, and service conditions. The unvested

shares have no voting rights and do not pay dividends.

The fair value of the restricted stock, RSUs, and Performance Shares at the date of grant is amortized to earnings over the

restriction period. Subsequent to the Spin-Off, we recorded compensation expense related to restricted stock, RSUs, and

Performance Shares of $11 million in 2012. The deferred tax benefit recorded related to this compensation expense was

$4 million in 2012. The unamortized compensation expense related to our restricted stock, RSUs, and Performance

Shares was $67 million at December 29, 2012 and is expected to be recognized over a weighted-average period of

two years.

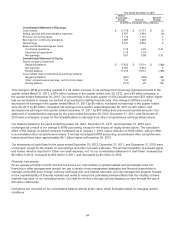

Our restricted stock, RSU, and Performance Share activity for the year ended December 29, 2012 was:

Number of Shares

Weighted-Average

Grant Date Fair

Value Per Share

Balance at January 1, 2012 - $ -

Converted on October 1, 2012 in connection with the

Spin-Off 3,606,583 34.49

Granted 426,194 41.95

Vested (43,490) 33.77

Forfeited (68,746) 34.08

Balance at December 29, 2012 3,920,541 35.32

The weighted-average grant date fair value of our RSUs granted was $18 million, or $41.95 per restricted or deferred

share, in the fourth quarter of 2012. The vesting date fair value of restricted stock, RSUs, and Performance Shares was $2

million in 2012.

62