Kraft 2012 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2012 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

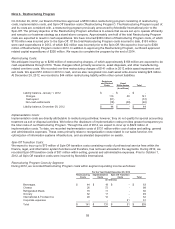

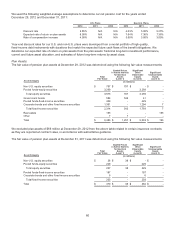

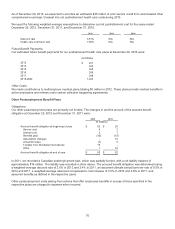

We used the following weighted-average assumptions to determine our benefit obligations under the pension plans at

December 29, 2012 and December 31, 2011:

U.S. Plans Non-U.S. Plans

2012 2011 2012 2011

Discount rate 4.05% N/A 4.00% 4.25%

Rate of compensation increase 4.00% N/A 3.00% 3.00%

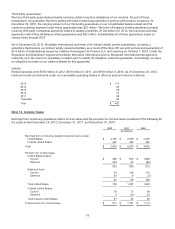

Components of Net Pension Cost:

Net pension cost consisted of the following for the years ended December 29, 2012, December 31, 2011, and

December 31, 2010:

U.S. Plans Non-U.S. Plans

2012 2011 2010 2012 2011 2010

(in millions)

Service cost $ 32 $ - $ - $ 12 $ 7 $ 7

Interest cost 70 - - 32 26 24

Expected return on plan assets (105) - - (43) (35) (31)

Market-based changes (46) - - 17 68 3

Actuarial losses 5 - - 11 16 2

Amortization of prior service cost 1 -----

Net pension cost $ (43) $ - $ - $ 29 $ 82 $ 5

We determine the expected return on plan assets based on asset fair values as of the measurement date.

As of December 29, 2012, we expected to amortize an estimated $4 million of prior service cost from accumulated other

comprehensive earnings / (losses) into net periodic pension cost for the combined U.S. and non-U.S. pension plans during

2013.

65