Kodak 2013 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Kodak does not utilize financial instruments for trading or other speculative purposes.

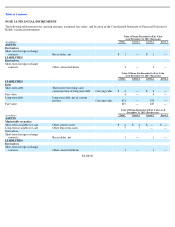

Fair Value

Fair values of Kodak’s forward contracts are determined using other observable inputs (Level 2 fair value measurements), and are based on the

present value of expected future cash flows (an income approach valuation technique) considering the risks involved and using discount rates

appropriate for the duration of the contracts. Transfers between levels of the fair value hierarchy are recognized based on the actual date of the

event or change in circumstances that caused the transfer. There were no transfers between levels of the fair value hierarchy during the four

months ended December 31, 2013 or the eight months ended August 31, 2013.

Fair values of long-term borrowings are determined by reference to quoted market prices, if available, or by pricing models based on the value

of related cash flows discounted at current market interest rates. The carrying values of cash and cash equivalents, restricted cash, investments

in trust and trade receivables (which are not shown in the table above) approximate their fair values.

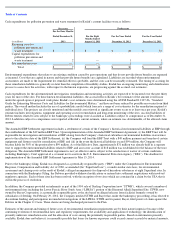

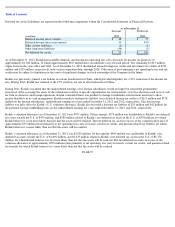

Foreign Exchange

Foreign exchange gains and losses arising from transactions denominated in a currency other than the functional currency of the entity involved

are included in Other income (charges), net in the accompanying Consolidated Statement of Operations. The net effects of foreign currency

transactions, including changes in the fair value of foreign exchange contracts, are shown below:

Derivative Financial Instruments

Kodak, as a result of its global operating and financing activities, is exposed to changes in foreign currency exchange rates, commodity prices,

and interest rates, which may adversely affect its results of operations and financial position. Kodak manages such exposures, in part, with

derivative financial instruments.

PAGE 90

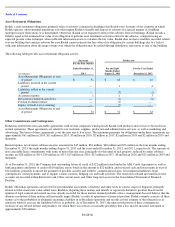

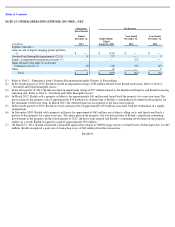

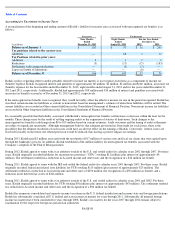

Value Of Items Not Recorded At Fair Value

As of December 31, 2012 (Predecessor)

(in millions)

Total

Level 1

Level 2

Level 3

ASSETS

Marketable securities

Long

-

term held

-

to

-

maturity

Other long

-

term assets

Carrying value

$

23

$

23

$

—

$

—

Fair value

23

23

—

—

LIABILITIES

Debt

Short-term debt

Short-term borrowings and current

portion of long

-

term debt

Carrying value

699

—

699

—

Fair value

686

—

686

—

Long-term debt

Long-term debt, net of current

portion

Carrying value

740

—

740

—

Fair value

606

—

606

—

Debt subject to compromise

Liabilities subject to compromise

Carrying value

683

—

683

—

Fair value

72

—

72

—

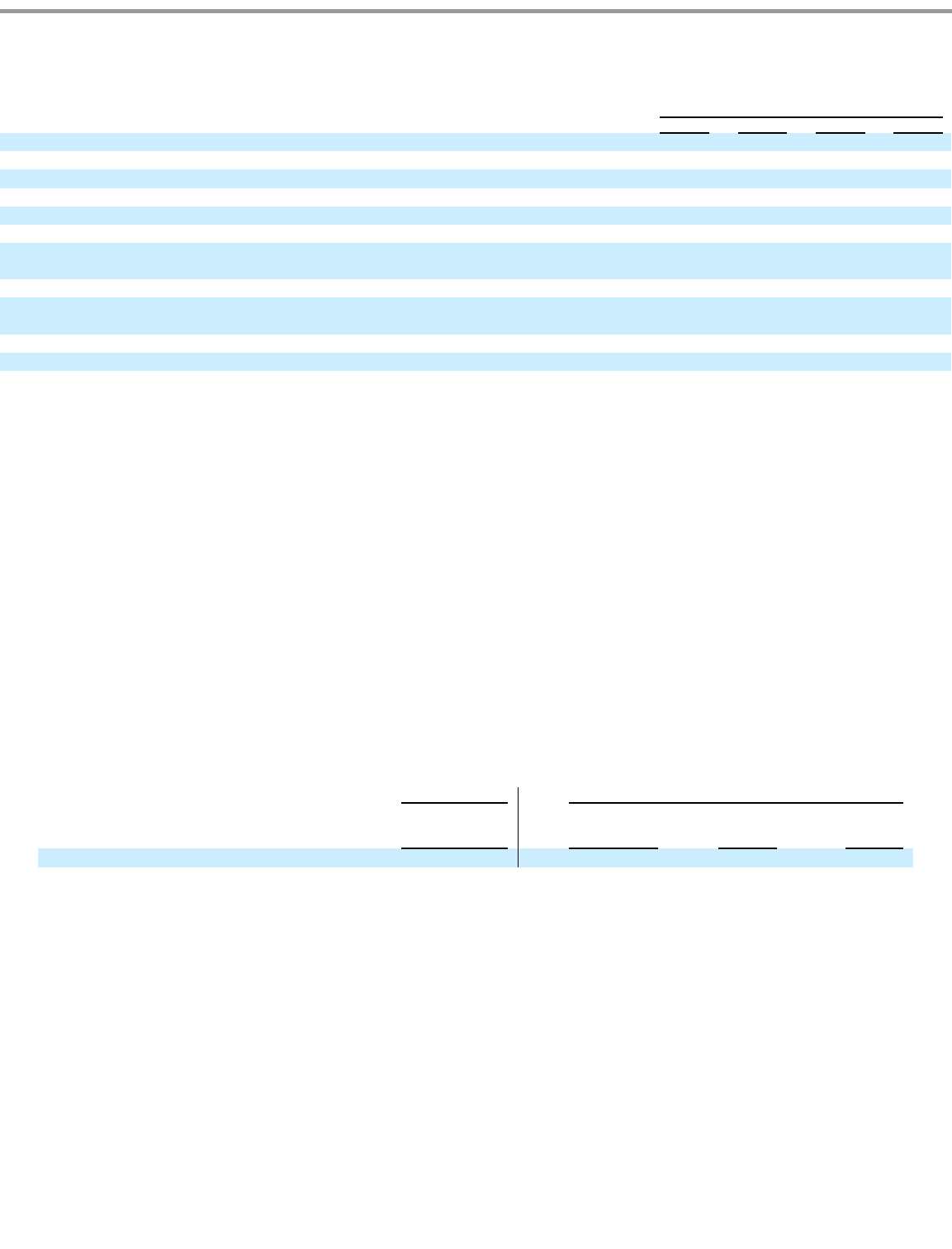

Successor

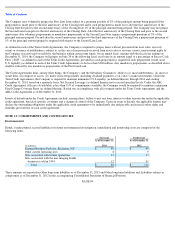

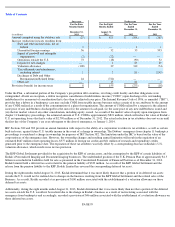

Predecessor

Four Months

Ended

Eight Months

Ended

Year Ended December 31,

(in millions)

December 31, 2013

August 31, 2013

2012

2011

Net loss

$

(5

)

$

(7

)

$

(14

)

$

(15

)