Kodak 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

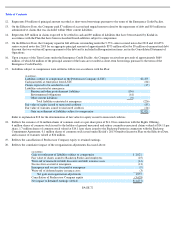

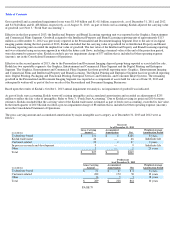

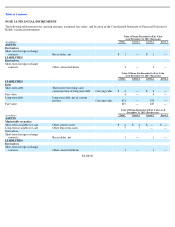

NOTE 11: SHORT-TERM BORROWINGS AND LONG-TERM DEBT

Debt and related maturities and interest rates were as follows at December 31, 2013 and 2012:

On February 1, 2013, Kodak entered into a series of agreements under which it received approximately $530 million of proceeds, net of

withholding taxes, a portion of which was paid by intellectual property licensees and a portion of which was paid by the acquirers of Kodak’s

digital imaging patent portfolio. Approximately $419 million of the proceeds were used to prepay the term loan under the Original Senior

Debtor-in-Possession (“DIP”) Credit Agreement. The Company paid the remaining outstanding term loan balance, in full, upon entering into

the Junior DIP Credit Agreement. Kodak recognized a loss on early extinguishment of debt of the term loan of approximately $6 million in the

first quarter of 2013.

On March 22, 2013, the Company and certain subsidiary guarantors entered into a Debtor-in-Possession Loan Agreement (the “Junior DIP

Credit Agreement”) with the lenders signatory thereto. Pursuant to the terms of the Junior DIP Credit Agreement, the lenders provided the

Company with term loan facilities in an aggregate principal amount of approximately $848 million consisting of approximately $473 million of

new money term loans (the “New Money Loans”), comprised of approximately $455 million original principal and approximately $18 million

of additional paid-in-kind of fees, and $375 million of junior term loans (the “Junior Loans”). Upon issuance of the New Money Loans, Kodak

received net proceeds of approximately $450 million ($455 million original principal less 1% stated discount). The Junior Loans were issued in

exchange for the same principal amount of a combination of the 2018 secured term notes and the 2019 secured term notes (collectively the

“Second Lien Notes”) pursuant to an offer by the Company to holders of the outstanding Second Lien Notes. The maturity date of the loans

made under the Junior DIP Credit Agreement was the earliest to occur of (i) September 30, 2013, (ii) the effective date of the Company’s plan

of reorganization and (iii) the acceleration of such loans.

On the Effective Date, in accordance with provisions in the Plan, the Company made payments totaling $1,221 million to repay, in full, the

Second Lien Notes and the Junior DIP Credit Agreement. The payments for discharge of existing debt also consisted of $5 million in exit fees.

In addition, $683 million of debt classified as liabilities subject to compromise was discharged pursuant to the Plan.

The carrying value of the 2017 Convertible Senior Notes was increased during the quarter ended June 30, 2012 to reflect the stated principal

amount of the notes. When the notes were initially issued, $107 million of the principal amount of the debt was allocated to reflect the equity

component of the notes. The remaining carrying value of the debt was originally being accreted to the $400 million

PAGE 82

Successor

Predecessor

As of

December 31, 2013

As of

December 31, 2012

(in million)

Country

Type

Maturity

Weighted

-

Average Effective

Interest Rate

Carrying Value

Carrying Value

Current portion:

U.S.

Term note

2014

7.89

%

$

4

$

—

U.S.

Original Senior

DIP Credit

Agreement

2013

8.63

%

—

659

Germany

Term note

2013

6.16

%

—

38

Brazil

Term note

2013

19.80

%

—

2

4

699

Non

-

current portion:

U.S.

Term note

2019

7.89

%

406

—

U.S.

Term note

2020

11.27

%

268

—

U.S.

Secured term note

2018

10.11

%

—

493

U.S.

Secured term note

2019

10.87

%

—

247

674

740

Liabilities subject to compromise:

U.S.

Term note

2013

6.16

%

—

20

U.S.

Term note

2013

7.25

%

—

250

U.S.

Convertible

2017

12.75

%

—

400

U.S.

Term note

2018

9.95

%

—

3

U.S.

Term note

2021

9.20

%

—

10

—

683

$

678

$

2,122