Kodak 2013 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

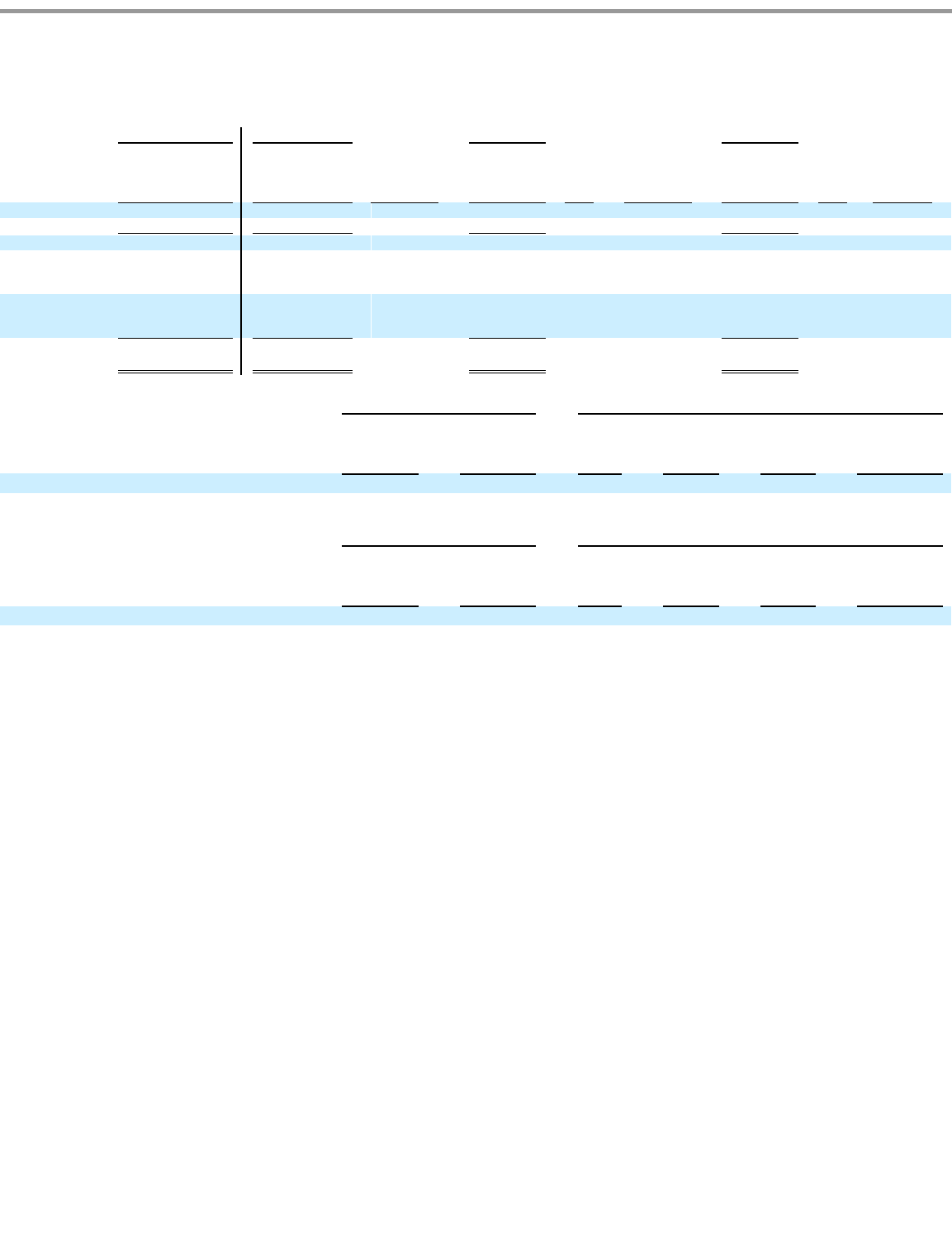

GRAPHICS, ENTERTAINMENT AND COMMERCIAL FILMS

Revenues

Current Year

The decrease in the Graphics, Entertainment and Commercial Films Segment net sales of approximately 10% for the year ended December 31,

2013 was primarily due to volume declines within Entertainment Imaging & Commercial Films (-9%), largely attributable to reduced demand

from movie studios, and within Graphics (-7%), largely attributable to lower demand for digital plates. Also contributing to the decline was

unfavorable price/mix within Graphics (-2%) due to pricing pressures in the industry. Partially offsetting these declines was favorable

price/mix within Intellectual Property and Brand Licensing (+6%) due to non-recurring intellectual property licensing agreements and within

Entertainment Imaging and Commercial Films

(+3%) due to pricing actions impacting the current year. The impact of the application of fresh

start accounting was not material.

Included in revenues were non-recurring intellectual property licensing agreements. Such agreements contributed approximately $38 million to

revenues in 2013. There were no significant non-recurring intellectual property licensing agreements in 2012. However, there was a $61

million licensing revenue reduction reflecting sharing, with licensees, of the withholding tax refund received in 2012 (refer to Note 17,

“Income Taxes” for additional information).

Prior Year

The decrease in the Graphics, Entertainment and Commercial Films Segment net sales of approximately 28% for the year ended December 31,

2012 was primarily driven by volume declines within Entertainment Imaging & Commercial Films (-10%), largely attributable to reduced

demand from movie studios, and within Graphics (-8%), largely attributable to lower demand. Also contributing to the revenue decline was

lower revenue within Intellectual Property and Brand Licensing (-

6%) due to the $61 million license revenue reduction reflecting sharing, with

licensees, of the withholding tax refund received in the first quarter of 2012 (refer to Note 17, “Income Taxes” for additional information).

Non

-recurring intellectual property licensing agreements contributed $82 million to revenues in 2011.

PAGE 37

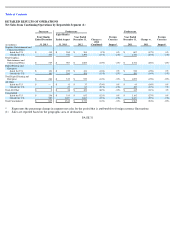

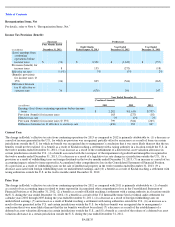

Successor

Predecessor

Predecessor

Predecessor

(in millions)

Four Months Ended

December 31, 2013

Eight Months

Ended August 31,

2013

% of Sales

(Combined)

Year Ended

December 31,

2012

% of

Sales

% Change

vs. 2012

(Combined)

Year Ended

December 31,

2011

% of

Sales

% Change

vs. 2011

Net sales

$

519

$

987

$

1,680

(10

%)

$

2,341

(28

%)

Cost of sales

472

805

1,509

(15

%)

1,853

(19

%)

Gross profit

47

182

15

%

171

10

%

34

%

488

21

%

(65

%)

Selling, general and

administrative

expenses

77

164

16

%

341

20

%

(29

%)

439

19

%

(22

%)

Research and

development

costs

7

13

1

%

40

2

%

(50

%)

57

2

%

(30

%)

Segment (loss)

earnings

$

(37

)

$

5

(2

%)

$

(210

)

(13

%)

85

%

$

(8

)

—

(

2,525

%)

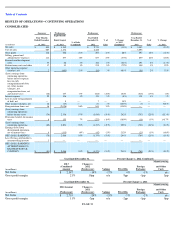

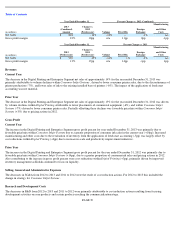

Year Ended December 31,

Percent Change vs. 2012 (Combined)

(in millions)

2013

(Combined)

Amount

Change vs.

2012

(Predecessor)

Volume

Price/Mix

Foreign

Exchange

Manufacturing

and Other

Costs

Net Sales

$

1,506

-

10

%

-

16

%

7

%

-

1

%

n/a

Gross profit margin

15

%

5pp

n/a

6pp

-

1pp

0pp

Year Ended December 31,

Percent Change vs. 2011

(in millions)

2012

(Predecessor)

Change vs.

2011

(Predecessor)

Volume

Price/Mix

Foreign

Exchange

Manufacturing

and Other

Costs

Net Sales

$

1,680

-

28

%

-

18

%

-

8

%

-

2

%

n/a

Gross profit margin

10

%

-

11pp

n/a

-

10pp

0pp

-

1pp