Kodak 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

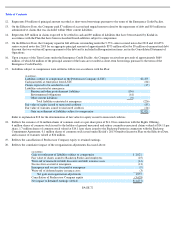

INCOME TAXES

Kodak recognizes deferred tax liabilities and assets for the expected future tax consequences of operating losses, credit carry-forwards and

temporary differences between the carrying amounts and tax basis of Kodak’s assets and liabilities. Kodak records a valuation allowance to

reduce its net deferred tax assets to the amount that is more likely than not to be realized. For discussion of the amounts and components of the

valuation allowances as of December 31, 2013 and 2012, see Note 17, “Income Taxes.”

The undistributed earnings of Kodak’s foreign subsidiaries are not considered permanently reinvested. Kodak has recognized a deferred tax

liability (net of related foreign tax credits) on the foreign subsidiaries’ undistributed earnings.

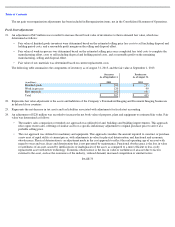

RECENTLY ADOPTED ACCOUNTING PRONOUNCEMENTS

In July 2013, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2013-11, “Presentation

of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists.” ASU

No. 2013

-11 provides that a liability related to an unrecognized tax benefit would be offset against a deferred tax asset for a net operating loss

carryforward, a similar tax loss or a tax credit carryforward if such settlement is required or expected in the event the uncertain tax position is

disallowed. In that case, the liability associated with the unrecognized tax benefit is presented in the financial statements as a reduction to the

related deferred tax asset for a net operating loss carryforward, a similar tax loss or a tax credit carryforward. In situations in which a net

operating loss carryforward, a similar tax loss or a tax credit carryforward is not available at the reporting date under the tax law of the

jurisdiction or the tax law of the jurisdiction does not require, and the entity does not intend to use, the deferred tax asset for such purpose, the

unrecognized tax benefit will be presented in the financial statements as a liability and will not be combined with deferred tax assets. The

adoption of this guidance did not have an impact on Kodak’s Consolidated Financial Statements.

In February 2013, the FASB issued ASU No. 2013-02, “Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive

Income.” ASU No. 2013-02 requires presentation of reclassification adjustments from each component of Accumulated other comprehensive

income either in a single note or parenthetically on the face of the financial statements, for those amounts required to be reclassified into net

income in their entirety in the same reporting period. For amounts that are not required to be reclassified in their entirety in the same reporting

period, cross-reference to other disclosures is required. The changes to the Accounting Standards Codification (“ASC”) as a result of this

update were effective prospectively for interim and annual periods beginning after December 15, 2012 (January 1, 2013 for Kodak). The

adoption of this guidance required changes in presentation only and did not have an impact on Kodak’s Consolidated Financial Statements.

In July 2012, the FASB issued ASU No. 2012-02, “Intangibles-Goodwill and Other (ASC Topic 350) – Testing Indefinite-Lived Intangible

Assets for Impairment.” ASU No. 2012-02 amends the impairment test for indefinite-lived intangible assets by allowing companies to first

assess the qualitative factors to determine if it is more likely than not that an indefinite-lived intangible asset might be impaired as a basis for

determining whether it is necessary to perform the quantitative impairment test. The changes to the ASC as a result of this update were

effective prospectively for annual and interim impairment tests performed for fiscal years beginning after September 15, 2012 (January 1, 2013

for Kodak). The adoption of this guidance did not impact Kodak’s Consolidated Financial Statements.

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

In March 2013, the FASB issued ASU No. 2013-05, “Foreign Currency Matters (Topic 830)—Parent’s Accounting for the Cumulative

Translation Adjustment upon De-recognition of Certain Subsidiaries or Groups of Assets within a Foreign Entity or of an Investment in a

Foreign Entity.” ASU No. 2013-05 specifies that a cumulative translation adjustment (“CTA”) should be released into earnings when an entity

ceases to have a controlling financial interest in a subsidiary or group of assets within a consolidated foreign entity and the sale or transfer

results in the complete or substantially complete liquidation of the foreign entity. For sales of an equity method investment that is a foreign

entity, a pro-rata portion of CTA attributable to the investment would be recognized in earnings upon sale of the investment. When an entity

sells either a part or all of its investment in a consolidated foreign entity, CTA would be recognized in earnings only if the sale results in the

parent no longer having a controlling financial interest in the foreign entity. The changes in the ASC are effective prospectively for annual and

interim periods beginning after December 15, 2013 (January 1, 2014 for Kodak). Kodak does not expect the adoption of the guidance will have

a material impact on its Consolidated Financial Statements.

In February 2013, the FASB issued ASU No. 2013-04, “Liabilities (Topic 405)—Obligations Resulting from Joint and Several Liability

Arrangements for Which the Total Amount of the Obligation Is Fixed at the Reporting Date.” ASU No 2013-04 requires an entity to measure

obligations resulting from joint and several liability arrangements for which the total amount of the obligation within the scope of this guidance

is fixed at the reporting date, as the sum of the following: the amount the reporting entity agreed to pay on the basis of its arrangement among

its co-obligors and any additional amount the reporting entity expects to pay on behalf of its co-obligors. The amendments in this update are

effective retrospectively for fiscal years, and interim periods within those years, beginning after December 15, 2013 (January 1, 2014 for

Kodak). Kodak does not expect the adoption of the guidance will have a material impact on its Consolidated Financial Statements.

PAGE 64