Kodak 2013 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

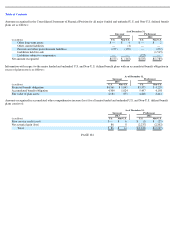

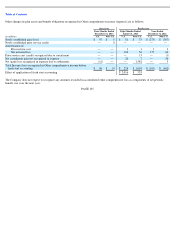

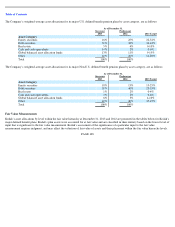

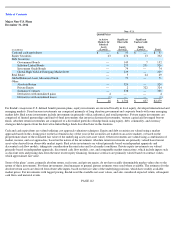

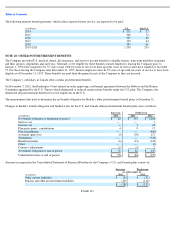

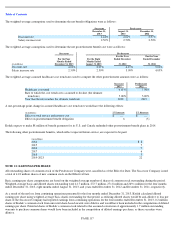

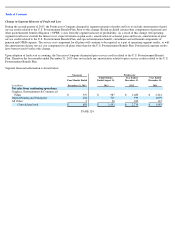

The following is a reconciliation of the beginning and ending balances of level 3 assets of Kodak’s major Non-U.S. defined benefit pension

plans (in millions):

Kodak expects to contribute approximately $0 million and $18 million in 2014 for the major U.S. and Non-U.S. defined benefit pension plans,

respectively.

PAGE 114

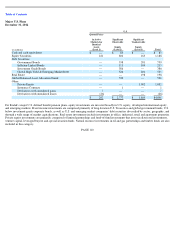

Predecessor

U.S.

Balance at

January 1,

2012

Net Realized and

Unrealized

Gains/(Losses)

Net Purchases

and Sales

Net Transfer

Into/(Out of)

Level 3

Balance at

December 31, 2012

Equity Securities

$

136

$

16

$

11

$

—

$

163

Government Bonds

237

27

(63

)

—

201

Inflation

-

Linked Bonds

260

21

(177

)

—

104

Global High Yield & Emerging Market

Debt

—

24

177

—

201

Absolute Return

135

10

20

(165

)

—

Real Estate

213

(9

)

(6

)

—

198

Private Equity

971

126

(95

)

—

1,002

Total

$

1,952

$

215

$

(133

)

$

(165

)

$

1,869

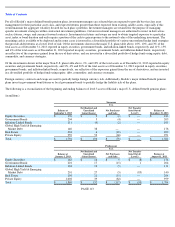

Successor

Non

-

U.S.

Balance at

September 1,

2013

Net Realized and

Unrealized

Gains/(Losses)

Net Purchases

and Sales

Net Transfer

Into/(Out of)

Level 3

Balance at

December 31, 2013

Equity Securities

$

15

$

1

$

(1

)

$

—

$

15

Government Bonds

30

2

—

—

32

Inflation

-

Linked Bonds

—

—

—

—

—

Real Estate

7

—

(

2

)

—

5

Private Equity

55

1

(2

)

—

54

Total

$

107

$

4

$

(5

)

$

—

$

106

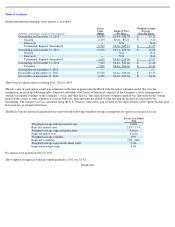

Predecessor

Non

-

U.S.

Balance at

January 1,

2013

Net Realized and

Unrealized

Gains/(Losses)

Net Purchases

and Sales

Net Transfer

Into/(Out of)

Level 3

Balance at

August 31, 2013

Equity Securities

$

13

$

2

$

—

$

—

$

15

Government Bonds

7

4

19

—

30

Inflation

-

Linked Bonds

251

21

(272

)

—

—

Real Estate

44

(5

)

(32

)

—

7

Private Equity

322

(26

)

(241

)

—

55

Total

$

637

$

(4

)

$

(526

)

$

—

$

107

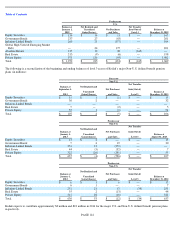

Predecessor

Non

-

U.S.

Balance at

January 1,

2012

Net Realized and

Unrealized

Gains/(Losses)

Net Purchases

and Sales

Net Transfer

Into/(Out of)

Level 3

Balance at

December 31, 2012

Equity Securities

$

6

$

1

$

6

$

—

$

13

Government Bonds

6

1

—

—

7

Inflation

-

Linked Bonds

251

21

13

(34

)

251

Real Estate

55

2

(13

)

—

44

Private Equity

312

28

(18

)

—

322

Total

$

630

$

53

$

(12

)

$

(34

)

$

637